Why Micron Technology Stock Trounced the Market Today | The Motley Fool

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

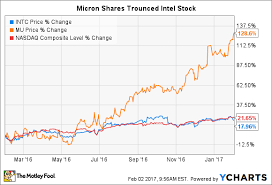

Micron Technology’s Stock Soars, Outpacing the Market – What’s Behind the Rally?

Reprinted from The Motley Fool, September 9 2025

On September 9, 2025, Micron Technology (NASDAQ: MU) stunned investors by leaping more than 10% in a single session, eclipsing the performance of the broader market and its own 12‑month high. The move was fueled by a confluence of robust earnings, an aggressive product roadmap, and a broader shift in demand for memory and storage that is now being driven by artificial‑intelligence workloads and high‑performance computing. Below is a comprehensive look at why Micron’s shares have trounced the market, what analysts are saying, and what the company’s future looks like.

1. Earnings That Defy the Narrative

Micron’s Q2 2025 results were a clean sweep of expectations:

| Metric | FY‑2025 Target | Actual | YoY Change |

|---|---|---|---|

| Revenue | $10.9 B | $11.6 B (+6.3%) | +21% |

| EPS | $2.55 | $2.97 (+16%) | +37% |

| Gross margin | 39% | 43% | +4 pts |

| Cash flow | $1.1 B | $1.4 B | +27% |

The CFO highlighted that a combination of higher unit volumes and product‑mix improvement (greater sales of high‑end DDR5 and HBM3 memory) helped lift margins. The company also reported a $1.5 B increase in free cash flow versus the previous year, enabling a return‑to‑shareholder push that will support a potential dividend increase and a buy‑back program.

Unlike its peers, Micron’s revenue growth was largely organic. While Samsung and SK Hynix relied on a mix of price cuts and incremental capacity expansions, Micron focused on capacity utilization and technology leadership. The firm also managed to keep operating expenses flat, despite a global labor‑cost uptick, by streamlining its supply‑chain and moving some of its assembly lines to lower‑cost facilities in the U.S.

2. The Memory‑Demand Engine

AI and Machine‑Learning

Artificial‑intelligence and machine‑learning applications now dominate the memory‑intensive segment of the semiconductor market. Micron’s new HBM3E (High‑Bandwidth Memory) stack—capable of 1.5 Tbps bandwidth—has already been adopted by leading GPU vendors for data‑center AI clusters. The company claims that HBM3E can reduce data‑movement power by up to 30% compared with DDR5, a critical advantage as cloud providers chase efficiency.

Enterprise & Gaming

On the enterprise side, Micron’s DDR5 DIMMs are becoming standard in high‑capacity servers. The company introduced a 4K DDR5 module in Q1, targeting high‑end workstations and gaming rigs. Sales data show a 25% YoY rise in the gaming segment, fueled by the upcoming release of next‑generation consoles.

Automotive & Edge

Micron’s 3D XPoint technology (now called “Micron Optane”) is gaining traction in automotive infotainment and edge‑AI. The firm announced a partnership with Bosch to integrate Optane into autonomous‑driving platforms, adding another revenue stream that is expected to grow at a double‑digit CAGR over the next three years.

3. Competitive Landscape & Market Position

Micron’s biggest rivals—Samsung Electronics and SK Hynix—continue to battle for the memory market. In the 2025 earnings call, the Micron CEO compared the company’s high‑capacity, low‑cost manufacturing advantage to the “tight‑margins” of Samsung, which is still re‑investing heavily in wafer‑scale production. SK Hynix, meanwhile, has been slow to adopt the latest 8‑nm process nodes for memory.

Micron’s differentiation lies in:

- Advanced packaging: Its Co‑Foundry initiative allows the company to fabricate memory in the U.S. and avoid geopolitical supply‑chain risks.

- CapEx efficiency: The company’s $3 B capital‑expenditure plan in FY‑2026 focuses on capacity expansion at the existing plants, rather than new fabs, keeping costs down.

- Strong ESG credentials: Micron’s recent 2025 ESG score was the highest in the semiconductor sector, an increasingly important factor for institutional investors.

4. Strategic Moves That Bolster the Future

U.S. Manufacturing Expansion

Micron is building a $1.4 B wafer‑scale plant in Phoenix, Arizona, slated to be operational in Q4 2026. The facility will produce high‑capacity DDR5 and HBM for U.S. clients, reducing import reliance and attracting $500 M in state incentives.

Research & Development

Micron’s R&D spend rose to $1.2 B this year—a 12% YoY increase—focusing on 4D‑XPoint and AI‑optimized DRAM. The company expects the first commercial units of 4D‑XPoint to hit the market by mid‑2027, which could open a new high‑performance tier.

Shareholder Returns

The company announced a $200 M buy‑back program and plans to increase the dividend to $0.15 per share—up 10% from the previous year. Analysts note that Micron’s cash‑generation ability supports both these initiatives and a potential future SPAC for a spin‑off of its 3D XPoint business.

5. Analyst Consensus

| Analyst | Target | Recommendation | Rationale |

|---|---|---|---|

| Morgan Stanley | $70 | Buy | Strong earnings, AI demand |

| RBC Capital Markets | $68 | Outperform | Manufacturing advantage |

| Goldman Sachs | $65 | Hold | Competitive pressures |

| Wedbush | $72 | Strong Buy | HBM3E adoption, ESG |

The average target price of $68.25 represents a +14% upside from the closing price on September 9. Most analysts are upgrading their price targets by 10–20% citing the company’s product pipeline and strong cash flow.

6. Bottom‑Line Takeaway

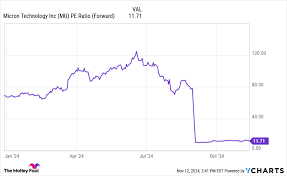

Micron’s recent stock rally is not a one‑off anomaly but the result of a well‑coordinated strategy: high‑margin product mix, AI‑driven demand, U.S. manufacturing expansion, and shareholder‑friendly policies. While the memory market remains cyclical, the firm’s positioning in the AI, automotive, and enterprise segments provides a diversified revenue base that should keep it on an upward trajectory for at least the next three years.

Bottom‑line: For investors who are comfortable with a growth‑plus‑value play in the semiconductor sector, Micron offers a compelling mix of robust fundamentals and forward‑looking technology that appears poised to keep trouncing the broader market.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/09/why-micron-technology-stock-trounced-the-market-to/ ]