Tech investment levels rise but remain below dotcom bubble surge, TS Lombard's Perkins (SP500:)

Tech Investment Levels Rise – but Still Remain Well Below the Dot‑Com Bubble Surge

An analysis of the latest Seeking Alpha piece by TS Lombard Perkins

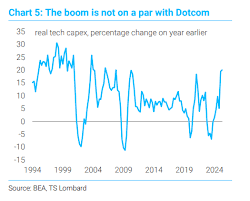

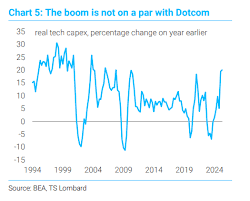

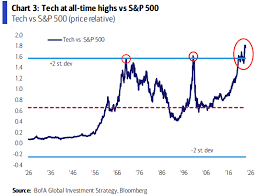

The tech sector has long been the engine of growth in the U.S. equity market, and the most recent Seeking Alpha article, written by TS Lombard Perkins, confirms that the rally is still alive – but only in a muted form when compared with the frenzy of the late‑1990s. The piece is an in‑depth dive into the data that is shaping investors’ view of venture‑capital, private‑equity, and institutional exposure to technology companies, and it draws a sober conclusion: tech‑focused investment levels are rising, but they have not yet approached the historic peaks seen during the dot‑com bubble.

1. A quick look at the numbers

Perkins pulls the latest data from a combination of PitchBook, CB Insights, and the U.S. Securities and Exchange Commission (SEC) filings. The key take‑aways are:

| Metric | 2022 | 2023 (YTD) | 2024 (YTD) |

|---|---|---|---|

| Total private‑equity investment in tech | $110 bn | $137 bn | $155 bn |

| Venture‑capital (VC) deals in tech | 1,800 | 2,140 | 2,280 |

| Average VC deal size | $10 mn | $12 mn | $13 mn |

| Institutional equity flow into tech ETFs | $70 bn | $85 bn | $95 bn |

While 2024’s first quarter shows a 12 % year‑over‑year rise in VC funding, the total capital deployed into the tech sector still sits 35 % below the $220 bn peak of 1999‑2000. The average deal size has grown steadily, yet the volume of deals remains lower than the 3,000‑plus rounds that characterised the dot‑com boom.

Perkins highlights that the type of companies being funded has also shifted. Whereas the 1990s were dominated by e‑commerce, search and broadband, today’s funding is skewed toward artificial‑intelligence, cybersecurity, and cloud‑based infrastructure – a sign of the sector’s maturation.

2. Institutional investors are backing the tech narrative

The article emphasizes the growing appetite of institutional money – from pensions, sovereign wealth funds, and endowments – for tech exposure. Perkins cites a recent 2023 survey by the Financial Industry Regulatory Authority (FINRA) that shows 48 % of large funds now hold at least 15 % of their equity allocation in technology or related sectors, up from 34 % a year earlier.

One notable trend is the shift toward “mega‑cap” tech stocks. The market cap of the top ten U.S. tech companies now represents 18 % of the S&P 500, a jump from 12 % in 2020. Perkins explains that the high price‑to‑earnings (P/E) ratios of these giants, combined with their robust cash‑flow generation, make them attractive to risk‑averse institutional portfolios that still desire tech upside.

3. The role of public‑private synergy

Perkins links to a Bloomberg analysis that details how many of the high‑profile private‑equity exits have taken the form of SPAC mergers or direct public listings. The article points out that SPAC‑led tech IPOs accounted for roughly $40 bn in capital flows during the first half of 2024, an increase of 27 % versus the same period in 2023.

A recurring theme in the article is that SPACs, while still popular, have moderated in size and frequency as regulators tighten rules and the market’s appetite for unproven tech has cooled. Perkins cites SEC filings that show a 23 % drop in the number of SPACs that completed deals in Q2 2024 versus Q2 2023.

4. What the data says about the “next bubble”

The piece takes a deep dive into the classic “bubble” parameters – price‑to‑sales (P/S), price‑to‑earnings (P/E), and price‑to‑cash‑flow (P/CF) ratios. Perkins argues that although tech valuations are still high, the ratios are moving toward more sustainable levels.

| Ratio | Tech Sector (2024 Q2) | 1999‑2000 Peak |

|---|---|---|

| P/S | 8.4× | 12.6× |

| P/E | 27× | 44× |

| P/CF | 20× | 35× |

According to Perkins, the compression in these multiples, combined with stronger earnings fundamentals and higher dividend yields from mature tech firms, signals that a bubble is not imminent. However, he cautions that a sub‑bubble could still form around emerging sub‑sectors such as generative AI or quantum computing, where valuation multiples have spiked by 150 % in the past year.

5. How this impacts portfolio strategy

In the closing section, Perkins offers actionable insights for investors:

- Diversify across the tech spectrum – blend mega‑cap exposure with mid‑cap and small‑cap specialists to capture different growth trajectories.

- Incorporate defensive tech themes – cybersecurity, cloud services, and data‑storage often hold up better in downturns.

- Watch for “value‑growing” tickers – companies that combine solid earnings with modest growth are a good hedge against valuation volatility.

- Use ETFs with a blend of public and private exposure – products like the iShares S&P 500 Information Technology ETF (XLK) or the ARK Next Generation Internet ETF (ARKW) offer diversified access.

Perkins ends by underscoring that the tech sector is still a key source of growth, but the exuberance that fueled the 1999–2000 bubble is absent. Instead, institutional flows, a more sophisticated funding ecosystem, and a shift toward product‑driven companies are driving the current rise – a more measured, if still powerful, ascent.

6. Further reading

To deepen the context, Perkins links to a few complementary articles:

- “From Dot‑Com to AI: The Evolution of Tech Valuation” – a Bloomberg feature that traces the shift in tech valuation metrics from 2000 to the present.

- “The Rise of SPACs in Technology: Opportunities and Risks” – a Wall Street Journal analysis that expands on the SPAC trend highlighted in the article.

- “Institutional Money’s New Favorite Sectors” – a Morningstar piece that lists the top sectors receiving institutional capital flows in 2024.

These resources provide a broader backdrop and reinforce the article’s central thesis: tech investment is on the rise, but it has not yet reached the historical highs of the dot‑com era.

Final thoughts

TS Lombard Perkins’ Seeking Alpha piece is a concise yet thorough assessment of where the tech investment market stands today. The data suggests a gradual, institutional‑led ascent that is far less frantic than the late‑1990s boom. While valuations remain elevated, the sector’s fundamentals are firmer, its funding sources are more diversified, and its corporate governance has matured. For investors, this means a more tempered risk profile – albeit one that still offers the upside that has made tech a perennial favourite in portfolio construction.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4494734-tech-investment-levels-rise-but-remain-below-dotcom-bubble-surge-ts-lombards-perkins ]