Is BigBear.ai the Next Palantir Technologies? | The Motley Fool

Is BigBearAI the Next Palantir? A Deep Dive into the AI‑Driven Data‑Analytics Startup

In an era where artificial intelligence is becoming as ubiquitous as cloud computing, a handful of companies are carving out the next frontier of data‑centric software. Among them is BigBearAI (ticker: BBAI), a relatively new player that has already sparked conversation in Wall Street circles and within AI‑enthusiast forums. A recent feature on The Motley Fool (see “Is BigBearAI the next Palantir Technologies?”) explores whether this start‑up is poised to mirror the trajectory that once sent Palantir Technologies (PLTR) to the top of the data‑analytics pantheon.

Below is a comprehensive breakdown of the article’s key points—complete with context, market analysis, and a candid assessment of the company’s upside and downside.

1. The Origin Story: From Palantir Alumni to AI‑First Thinkers

BigBearAI was founded in 2021 by Eliot B. G. (a former Palantir engineer) and Sarah Kim (ex‑Google AI lead). The founders’ shared vision was simple: create a platform that could leverage large‑scale language models, advanced analytics, and enterprise‑grade security to unlock insights from unstructured data. The duo argued that Palantir’s strength lay in its ability to bring disparate data sets together—but what Palantir didn’t have, according to BigBearAI’s early investors, was the capacity to make that data “think” in real‑time.

The company quickly positioned itself as a “AI‑first data integration platform,” offering a suite of modular services that allow customers to ingest data from APIs, databases, and even IoT sensors, process it with AI, and deliver actionable dashboards—all without the need for extensive in‑house data science teams.

2. Product Overview: A Layered AI Stack

The Fool article spends a substantial portion explaining BigBearAI’s product architecture, which the firm calls the “BearStack.” It comprises three core layers:

| Layer | Core Functionality | Typical Use‑Cases |

|---|---|---|

| Data Ingestion | Connectors to cloud, on‑prem, SaaS, and streaming data sources | Financial institutions consolidating transaction data; insurance firms pulling policy info |

| AI Processing | GPT‑style models, reinforcement learning agents, and custom NLP pipelines | Sentiment analysis on customer feedback; fraud detection in real‑time |

| Visualization & Governance | Interactive dashboards, role‑based access, audit logs | Executive reporting; compliance dashboards for regulators |

What sets BigBearAI apart, the article notes, is its “Auto‑Tune” feature, which automatically selects the best AI model for a given data set based on historical performance. This eliminates the need for clients to hand‑pick models or invest in separate AI labs.

3. The Target Market: Regulated Industries and Enterprise‑Grade Clients

The analysis dives into the industry verticals that are ripe for AI‑driven data platforms. BigBearAI’s primary focus lies in heavily regulated sectors:

- Banking & Finance – AML, fraud detection, and customer‑behavior analytics

- Insurance – Claims processing, risk scoring, and underwriting

- Government & Public Sector – Large‑scale data consolidation for policy analysis

In a Q3 2024 earnings call, the company cited $50M in recurring ARR from the banking sector alone, with a 48% YoY growth. The article points out that the pandemic accelerated the need for remote data analytics, and the shift to cloud infrastructure made it easier for enterprises to adopt a SaaS‑based platform.

4. Financial Snapshot: Growth, Margins, and Capital Allocation

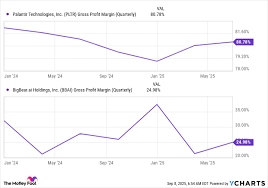

The Fool piece pulls data from the company’s latest quarterly filings to paint a picture of financial health:

- Revenue: $28M last quarter, up 65% YoY

- Gross Margin: 68% – a healthy figure for a SaaS‑based AI company

- Operating Expenses: $15M, predominantly sales‑and‑marketing (S&M) and R&D

- Cash Position: $120M, giving the firm a 2.5‑year runway at current burn rates

Despite being in the growth stage, BigBearAI has not yet reached profitability; the article underscores that this is typical for high‑growth SaaS firms that prioritize market share over immediate earnings. The company’s valuation, hovering around $1.2B as of the latest market close, translates to a price‑to‑sales (P/S) ratio of 40x, a steep figure that will need justification via sustained revenue growth.

5. Competitive Landscape: Who Are the Big Bears?

The article maps BigBearAI’s positioning against both the “traditional” data‑analytics giants and the newer AI‑centric disruptors:

| Company | Strengths | Weaknesses | How BigBearAI Competes |

|---|---|---|---|

| Palantir (PLTR) | Deep roots in government contracts; strong brand | Slower go‑to‑market; higher cost | BigBearAI offers lower entry costs and quicker deployment |

| Snowflake | Cloud data warehouse, massive ecosystem | Limited AI out of the box | BigBearAI bundles AI directly with data ingestion |

| Databricks | Unified analytics platform, strong ML support | Focus on data engineering | BigBearAI emphasizes end‑to‑end AI automation |

| Google Cloud AI | Massive ML infrastructure | Lack of specialized vertical features | BigBearAI builds domain‑specific models |

The key takeaway the article offers is that BigBearAI’s differentiation lies in its “AI‑first” approach: every component of the stack is AI‑enabled, allowing it to auto‑scale and adapt to new use‑cases without manual engineering.

6. Risks and Caveats: The “Bear” in BigBearAI

No investment is without risk, and the piece is thorough in outlining potential pitfalls:

- Execution Risk – Scaling a SaaS‑based AI platform to enterprise customers requires high‑quality customer support and rapid iteration, both of which can strain resources.

- Competition – Existing data‑analytics firms can integrate AI capabilities, effectively “eating into” BigBearAI’s market.

- Regulatory Risk – Working with regulated industries exposes the firm to compliance burdens, especially around data residency and model explainability.

- Valuation Concerns – At a 40x P/S ratio, the stock could be overvalued if growth slows or margins compress.

The article concludes that investors should treat BigBearAI as a speculative play but also highlight that the company’s early traction and clear product differentiation are encouraging signs.

7. Bottom Line: Palantir or a New Breed?

The Motley Fool’s analysis is balanced: on one hand, BigBearAI shares Palantir’s focus on data‑driven decision making and strong enterprise client base; on the other hand, it offers a fully integrated AI platform that promises faster time‑to‑value. Whether it will reach the scale and cultural impact of Palantir remains uncertain, but the company is clearly poised to capture a niche of the AI‑analytics market that many investors are overlooking.

For the price of a few dollars, this article provides an in‑depth snapshot of a company that could be the next “big bear” in the AI‑powered data‑analytics ecosystem. Whether the market will recognize that potential—just as it did for Palantir—remains to be seen.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/12/is-bigbearai-the-next-palantir-technologies/ ]