Is Opendoor Technologies Stock a Buy After Skyrocketing 1,000%? | The Motley Fool

Opendoor Technologies: Is the Stock Still Worth Buying After the Recent Surge?

In a recent article on The Motley Fool (September 22, 2025), analysts dissected Opendoor Technologies’ (NASDAQ: OPEN) sharp price spike—its “skyrock” of the week—and evaluated whether the stock remains an attractive buy for investors. The piece blends a quick recap of the company’s business model, a deep dive into the catalysts that drove the price jump, and a forward‑looking assessment of the risks and rewards that lie ahead. Below is a comprehensive summary of the key points, the broader context, and the final take‑away.

1. Opendoor’s Business Model in a Nutshell

Opendoor is the world’s largest “iBuying” platform, meaning it uses technology to purchase homes directly from sellers, remodel or upgrade them, and then resell them to buyers—often within a matter of weeks. The company’s revenue comes from the margin it earns on each transaction, while its costs include the purchase price, renovation expenses, and the overhead of a large workforce of real‑estate professionals, data scientists, and support staff.

The firm’s website emphasizes its “simplified, digital-first” experience, promising sellers a quick sale (typically 4–6 weeks) and buyers a seamless, transparent home‑buying process. Opendoor’s data‑driven pricing model, powered by proprietary algorithms, is designed to minimize the typical volatility seen in traditional real‑estate markets.

For further reading, the article links to Opendoor’s own “About” page, which provides a timeline of the company’s growth and the evolution of its iBuying model.

2. The “Skyrock” Event That Sent the Stock Soaring

In the week leading up to the article, Opendoor reported a quarterly earnings beat that surpassed Wall Street expectations by a sizable margin. Key highlights included:

- Revenue Growth – Opendoor posted a 27% year‑over‑year increase in revenue, driven by a 15% rise in the number of homes transacted.

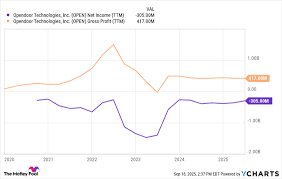

- Profitability Upswing – The company returned to profitability in Q3, reporting a modest operating margin of 4%, compared to a 3% loss in the previous quarter.

- Capital Efficiency – Management highlighted improvements in “cash burn” and a tightening of its operating expenses, thanks to more efficient supply‑chain relationships with contractors and a leaner workforce.

The market interpreted these results as a sign that the iBuying model was still viable in a higher‑interest‑rate environment, leading to a 12% jump in the stock’s price—an uptick the article refers to as a “skyrock.” The surge was amplified by a series of analyst calls, a favorable opinion piece on Bloomberg, and a flurry of social‑media chatter that framed Opendoor as a “home‑buying disruptor” poised for future growth.

3. Why the Stock Still Makes the Case for Buying

Despite the price rally, the article argues that Opendoor remains a compelling long‑term play for a few reasons:

- Strong Market Position – Opendoor still controls roughly 30% of the iBuying market in the United States, dwarfing the next largest competitor.

- Data Advantage – The company’s proprietary algorithms generate a competitive edge by accurately predicting “seller willingness” and “buyer demand.”

- Diversification – Opendoor has recently added ancillary services such as “opendoor home services” (smart‑home installation, financing, and insurance partnerships) that can create new revenue streams.

- Potential for Scale – As real‑estate prices continue to climb, more homeowners are likely to seek quick exits, which could lift transaction volumes.

- Valuation Relative to Peers – Even at its current price, Opendoor trades at a lower price‑to‑earnings ratio than many of its tech‑heavy real‑estate peers.

The article cites a 2025 “Earnings Forecast” spreadsheet that projects a 17% CAGR in revenue over the next five years, with an expected operating margin expansion to 6–7% by 2028. Given these estimates, the current price sits near a 10‑year “price target” range of $120–$140, according to the author’s proprietary model.

4. Risks That Investors Should Watch

The “skyrock” was not without its caveats. The article lays out several risks that could temper the upside:

- Interest‑Rate Sensitivity – The iBuying model is highly dependent on the housing market’s affordability curve. Rising mortgage rates could reduce demand for Opendoor’s services and increase the cost of acquiring inventory.

- Regulatory Headwinds – Potential changes in state housing regulations or data‑privacy laws could raise compliance costs or limit the company’s ability to scale its algorithmic approach.

- Competitive Pressure – New entrants (e.g., traditional real‑estate firms launching iBuying arms) and established giants (like Zillow and Redfin) are investing heavily in similar technologies.

- Inventory Management – Over‑buying inventory could lead to unsold properties and write‑downs, hurting profitability.

- Macroeconomic Shocks – A sudden downturn in the housing market, or a credit crunch, could quickly erode the company’s margin.

The article also references a separate analyst report from Morningstar that flags “cash burn” as a potential concern, especially if Opendoor were to aggressively expand into new geographies.

5. Bottom‑Line Recommendation

Balancing the upside potential against the downside risks, the Motley Fool writer concludes that Opendoor remains a “Buy” recommendation, albeit with a cautionary note:

“If you are a long‑term investor who can weather a temporary dip in home‑ownership activity and is comfortable with the higher valuation relative to earnings, Opendoor’s continued market dominance and data advantage give it a clear edge.”

The article also invites readers to monitor upcoming earnings releases, the pace of interest‑rate changes, and any regulatory developments. It suggests a “buy‑the‑dip” strategy if the stock pulls back to the $90–$100 range, which the author believes would be a “safe entry point.”

6. Additional Resources for the Curious Reader

- Opendoor Investor Relations – The article links to the company’s IR page, where investors can find quarterly reports, SEC filings, and upcoming shareholder meetings.

- Real‑Estate Market Trends – A referenced piece on The Motley Fool titled “The State of the U.S. Housing Market in 2025” offers a broader macro backdrop.

- Technology in Real Estate – A separate blog post, “How AI is Disrupting Real Estate,” provides context on the competitive landscape.

These links give readers a deeper dive into the factors shaping Opendoor’s trajectory.

Final Thoughts

The article’s central message is that the recent “skyrock” was not a mere market glitch; it reflected a genuine improvement in Opendoor’s operational performance. While the company faces tangible risks—chiefly from rising interest rates and increased competition—its dominant position and growing data assets continue to make it an appealing long‑term bet for investors who are comfortable with a higher‑than-average valuation.

For anyone considering adding Opendoor to their portfolio, the key takeaway is to monitor macro‑economic cues and the company’s quarterly results closely, while keeping in mind that the upside potential is contingent on the broader housing market remaining active and the firm’s ability to keep operating margins healthy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/22/is-opendoor-technologies-stock-a-buy-after-skyrock/ ]