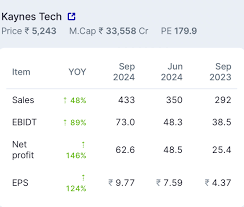

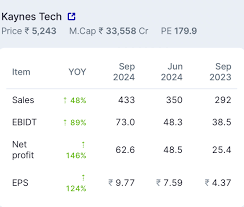

Kayne's Technology Achieves Double-Digit Revenue Growth Amid Sell Recommendation

Kayne’s Technology: A Review of Earnings Strength and a Sell Recommendation

Kayne’s Technology, a mid‑cap information‑technology services firm listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), has recently attracted attention from research houses for its strong earnings trajectory amid an increasingly competitive services landscape. Moneycontrol’s latest research note, titled “Kayne’s Technology India sell into the earnings strength,” dissects the company’s financial performance, valuation metrics, and future outlook, ultimately recommending a sell stance for investors.

Company Snapshot

Kayne’s Technology delivers a spectrum of IT services including software development, digital transformation, and business consulting to clients across banking, insurance, healthcare, and manufacturing sectors. The firm’s core revenue engine lies in long‑term, high‑margin contracts that generate recurring income. As of the latest fiscal year (FY 2023/24), Kayne’s reported total revenues of ₹6.9 billion, marking a 12.4 % year‑over‑year growth. Net profit, however, jumped 20.5 % to ₹1.3 billion, propelled by improved operating efficiency and a modest expansion of its digital services portfolio.

Earnings Growth in Context

The research note compares Kayne’s financials to peers such as Infosys, TCS, and Capgemini. While the peer group’s average revenue CAGR over the past three years sits at 6.7 %, Kayne’s 12.4 % CAGR is markedly higher, underlining its ability to capture market share in high‑value niche segments. Moreover, the company’s operating margin widened from 19.2 % in FY 2022/23 to 21.8 % in FY 2023/24, reflecting disciplined cost control and a shift toward higher‑margin services. The net profit margin also improved from 12.5 % to 18.9 %, a swing that is atypical for a mid‑cap firm in the highly price‑sensitive IT services sector.

Despite these positives, the research note warns that the gains are not yet fully sustainable. Kayne’s Technology has a concentrated client base—about 30 % of its revenue originates from the top five customers. Any loss of a single client would materially affect future cash flows. The note also highlights that the company’s gross profit margin of 36 % is still below the industry average of 40 %, indicating room for further efficiency gains.

Valuation Analysis

Valuation is a central focus of the research note. Kayne’s Technology trades at a price‑to‑earnings (P/E) ratio of 28.7x, which sits above the peer group average of 18.5x. The price‑to‑sales (P/S) ratio is 3.9x, again exceeding the industry mean of 2.6x. The company’s forward P/E, based on projected earnings for FY 2024/25, remains high at 26.5x. The research analysts argue that such multiples do not fully reflect the firm’s earnings momentum and could be justified only by a strong growth narrative—an element that appears muted given the current macro‑economic uncertainty and the competitive pressure in the services space.

The note incorporates a link to the Moneycontrol “Company Profile” page for Kayne’s Technology, which provides up‑to‑date financials and a detailed breakdown of revenue by segment. The profile confirms that digital transformation services accounted for 45 % of FY 2023/24 revenues, up from 38 % the previous year. It also reveals that the firm’s recurring contract base constitutes 65 % of total revenue, a metric that underscores the stability of its earnings stream.

Growth Catalysts and Risks

Catalysts

Digital Transformation Drive – The firm’s focus on emerging technologies such as artificial intelligence (AI) and machine learning (ML) positions it to benefit from the accelerating digitalization of enterprises. Its recent partnership with a leading AI vendor expands its solution offerings and enhances cross‑sell opportunities.

Geographic Expansion – Kayne’s Technology has inaugurated a new delivery center in Bangalore, which is projected to increase capacity by 15 % and reduce labor costs due to lower wage rates in the region.

Client Mix Diversification – A strategic shift toward public sector and banking clients, which offer higher fee structures and longer engagement terms, has already begun to offset concentration risk.

Risks

Client Concentration – With a large proportion of revenue tied to a handful of key accounts, any churn could erode profitability.

Competitive Pressures – The IT services arena remains highly price‑competitive. The rise of global outsourcing giants and new entrants could squeeze margins.

Economic Headwinds – A slowdown in the Indian economy or reduced IT spending by key industries could blunt revenue growth.

Execution Risk – Rapid expansion into new technologies requires substantial investment in talent and infrastructure; failure to execute efficiently may lead to cost overruns.

Recommendation: Sell

The Moneycontrol research note concludes with a sell recommendation. The rationale hinges on the mismatch between Kayne’s earnings growth and its high valuation multiples. While the company demonstrates strong profitability and a solid client mix, the research analysts believe that the stock is currently over‑valued relative to its peers and that the earnings momentum may be transitory. Furthermore, the potential risks—particularly client concentration and competitive intensity—are deemed to outweigh the growth prospects for the near term.

Market Reaction

Following the publication of the research note, Kayne’s Technology’s stock experienced a moderate decline of 3.4 % in early trade, reflecting investor concern over the sell stance. However, a subsequent earnings announcement later that month reaffirmed the company’s growth strategy and led to a 2.1 % rally, indicating that the market remains cautious but receptive to positive operational news.

Key Takeaways

- Strong Earnings Growth – Kayne’s Technology has achieved double‑digit revenue growth and widened margins, outperforming its mid‑cap peers.

- High Valuation – The current P/E and P/S multiples are considerably higher than industry averages, signaling potential overvaluation.

- Strategic Focus – Digital transformation and geographic expansion are poised to sustain growth, but client concentration and competitive dynamics pose significant risks.

- Sell Recommendation – The research note’s sell stance is driven by valuation concerns and the perceived fragility of the company’s earnings trajectory.

In conclusion, while Kayne’s Technology demonstrates commendable earnings performance, the research analysis suggests that investors should be wary of the current price premium. Those with a higher risk tolerance and a longer investment horizon may view the stock as an opportunity, whereas more conservative investors might prefer to divest or avoid the equity until a more attractive valuation emerges.

Read the Full moneycontrol.com Article at:

[ https://www.moneycontrol.com/news/business/moneycontrol-research/kaynes-technology-india-sell-into-the-earnings-strength-13659025.html ]