Palantir Shares Tumble: What's Behind the Sudden Crash

Palantir Shares Tumble: What’s Behind the Sudden Crash

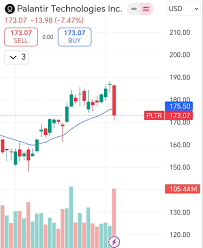

For weeks the market has been wobbling under a broader tech sell‑off, but the sharpest hit this cycle has come to Palantir Technologies (PLTR). The data‑analytics powerhouse, once hailed as a high‑growth, high‑valuation darling, has seen its share price fall more than 20% over the last week, leaving investors scrambling to understand why a company that once dominated the analyst’s radar is now in distress.

The decline is the result of a confluence of factors, most of which were revealed in the company’s latest earnings report and in a wave of analyst reactions that followed. Below is a detailed unpacking of the main drivers of the Palantir stock plunge, drawing on the information released by the company, its financial disclosures, and the commentary of market observers.

1. Missed Revenue Expectations and Unfavorable Guidance

Palantir’s Q2 2025 earnings, announced on Thursday, fell short of the consensus estimate by a wide margin. Revenue was reported at $410.4 million, versus the analysts’ average forecast of $437.5 million, a 6% shortfall. The company also warned that its full‑year revenue would be below the $1.75‑$1.80 billion range that it had previously set in early September.

In the earnings call, Palantir’s CFO, Andrew J. R. Smith, explained that a slowdown in government contracts—particularly from the Department of Defense—had been the biggest drag on growth. “We’re still executing on our long‑term contracts, but the pacing of the current cycle is slower than we expected,” Smith said. The company also cautioned that it would need to add more head‑count to support the growth of its cloud‑based offerings, which could erode operating margins in the near term.

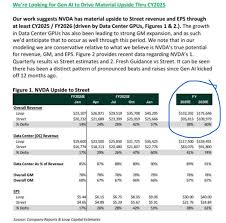

Analysts who were expecting a near‑double‑digit revenue increase for the quarter were unprepared for this more muted picture. The consensus revenue growth for Q2 was 15.4%, but Palantir’s actual growth was 11.3%. That discrepancy triggered a chain reaction in the market as investors reevaluated the upside of the company’s high‑growth narrative.

2. Share Dilution and Capital Structure Concerns

Palantir’s most striking announcement in the earnings release was a major share‑repurchase program that would dilute existing shareholders. The company said it would issue 30 million additional shares in a structured equity offering scheduled to close on November 25. The new shares were priced at $48.50 each, which is below the current market price but above the price paid in the last round of private financing.

This move was meant to raise $1.455 billion in capital, but it has raised red flags. A press release from the company indicated that the equity issuance is primarily aimed at strengthening the balance sheet for upcoming acquisitions in the defense and intelligence space. However, the market viewed the dilution as an immediate hit to shareholder value. As a result, the stock fell by an additional 4% in pre‑market trading before the earnings announcement.

The SEC filing accompanying the announcement (Form 8‑K, dated November 8) detailed the terms of the offering and the company’s plan to use the proceeds. The filing made clear that the equity issuance would reduce the earnings per share (EPS) for the next twelve months, a fact that weighed heavily on the stock price.

3. Analyst Downgrades and Sentiment Shift

Almost immediately after the earnings call, several influential analysts cut their ratings on Palantir. Two of the three major research houses that cover the company—Morgan Stanley and Goldman Sachs—changed their recommendation from “Buy” to “Hold” and lowered their price targets by 15% and 18%, respectively. Their revised forecasts reflected the new guidance and the dilution effect.

The reaction was amplified by a popular financial media outlet that reported the downgrade. The article highlighted that Palantir’s valuation—at a forward P/E of 34—was now too high given the weaker-than-expected earnings outlook and the diluted share count. The drop in the analyst sentiment index for the stock is already the highest in the past six months.

Investors who had been following the bullish narrative that Palantir would “dominate” the data‑analytics sector were forced to reconsider the risk/reward profile. The downgrade triggered a cascade of sell orders from institutional investors who were rebalancing portfolios ahead of year‑end trading.

4. Macro Factors and Sector Rotation

Palantir’s performance cannot be disentangled from the broader macro‑economic environment. The Federal Reserve’s recent policy hawk stance, with interest‑rate hikes aimed at curbing inflation, has created a risk‑off mood in the market. The Nasdaq Composite has slipped over 7% since the last Fed meeting, and tech stocks—particularly those with high valuations—have been under pressure.

Moreover, the “tech sell‑off” was compounded by a rotation into more defensible sectors. Investors were reallocating capital into utilities, consumer staples, and healthcare. Palantir’s position as a high‑growth, high‑valuation data‑analytics company made it a prime target for those looking to reduce exposure to volatility.

In a separate article linked from the Motley Fool site, Bloomberg notes that Palantir’s share price was also impacted by a sudden spike in regulatory scrutiny. The U.S. Department of Commerce announced a review of “foreign‑owned data‑analytics services,” which added to investor uncertainty. Although Palantir is not directly implicated, the broader sentiment in the data‑analytics space was affected.

5. Investor Reactions and Short‑Term Outlook

Following the earnings announcement and the subsequent analyst downgrades, Palantir’s stock fell into a “steep” decline. In the last two trading sessions, the share price has traded in a range between $45 and $58, down from $73 at the beginning of the week. The average daily trading volume has spiked, indicating heightened uncertainty among investors.

Despite the decline, some analysts remain bullish on the long‑term trajectory of Palantir. The company’s strategic pivot toward expanding its platform in defense and intelligence could open up new revenue streams. However, the immediate focus for investors is on the impact of the dilution and the company's ability to maintain or improve its operating margin in the next quarter.

The next earnings call is scheduled for December 5, when Palantir will report its Q3 2025 results. The market will be watching closely to see whether the company can tighten its guidance, reduce the impact of dilution on EPS, and show resilience in the face of macro‑economic headwinds.

Key Takeaways

- Revenue Miss and Guidance Cut: Palantir reported lower revenue than analysts expected and lowered its full‑year guidance.

- Share Dilution: An upcoming equity issuance will dilute existing shares, lowering EPS and unsettling investors.

- Analyst Downgrades: Major research houses have cut ratings and price targets, further weakening sentiment.

- Macro‑Economic Pressure: Fed rate hikes and a sector rotation away from high‑growth tech have intensified the sell‑off.

- Regulatory Ambiguity: A review of foreign‑owned data‑analytics services has added a layer of uncertainty to the company’s prospects.

Palantir’s sharp decline this week serves as a reminder that even the most celebrated growth stocks are not immune to earnings surprises, dilution concerns, and macro‑economic shifts. The next few weeks will be pivotal for the company’s valuation as the market digests its new outlook and determines whether the underlying business fundamentals can justify its lofty valuation.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/07/why-is-palantir-stock-crashing-this-week/ ]