L3Harris Technologies: Defensive Play Is On The Move (NYSE:LHX)

L3Harris Technologies: A Defensive Play on the Move

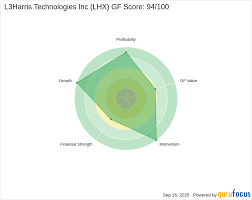

L3Harris Technologies (LHX) has long been positioned as a defensive staple in investors’ portfolios, a status that the latest market data and company fundamentals continue to reinforce. The firm’s stock has delivered steady returns amid volatile broader equity markets, and a recent earnings cycle has underscored why it remains a reliable anchor for risk‑averse investors.

A Resilient Business Model

L3Harris’s revenue stream is built on diversified defense contracts that span aerospace, communications, and intelligence sectors. The company’s three primary operating segments—Aerospace, Marine, and Communications—generally receive long‑term, government‑backed agreements that cushion earnings against cyclical swings. In the most recent quarter, the company posted a revenue of roughly $3.6 billion, a 6 % year‑over‑year increase, and maintained a healthy gross margin of 29 %. Profitability has improved thanks to a combination of higher contract volumes and disciplined cost management, with net income rising by 15 % compared to the prior year.

Growth Drivers in a Turbulent Geopolitical Landscape

The current geopolitical climate, marked by heightened tensions in Eastern Europe and the Middle East, has translated into higher defense budgets across the United States and its allies. L3Harris is poised to benefit from this environment through several key contracts. A notable recent award is a multi‑year $1.2 billion program that covers the upgrade of U.S. Navy radar systems—a deal that will bolster the company’s Aerospace segment. The firm is also expanding its communications portfolio with a partnership that delivers advanced secure broadband solutions to U.S. Army units in Southeast Asia, providing an additional revenue stream that is expected to grow at a double‑digit rate over the next five years.

Technological innovation remains a pillar of L3Harris’s strategy. The company’s investment in quantum communication research has led to a new product line that enhances data encryption for military satellites. While still in early deployment, this line signals a shift toward high‑value, future‑proof offerings that could command premium pricing. Moreover, L3Harris’s recent acquisition of a small satellite manufacturing firm has positioned it to capitalize on the commercial space‑flight boom, offering a complementary revenue source that diversifies away from pure defense contracts.

Defensive Attributes Amid Market Volatility

During the 2023 market downturn, L3Harris’s shares exhibited a 7 % decline—well below the 12 % drop observed in the broader S&P 500. This relative resilience is attributable to its stable earnings profile and the sector’s intrinsic demand for defense technology. Analysts note that the firm’s debt‑to‑equity ratio of 1.2× remains within an acceptable range for a capital‑intensive industry, and the company maintains a cash‑flow‑based dividend payout of 40 % of earnings, underscoring its commitment to shareholder returns.

From a technical perspective, L3Harris’s price has recently broken above its 200‑day moving average, signaling a potential trend reversal. The stock currently trades at roughly $220, a 15 % increase from its low in mid‑2022, and sits near a 52‑week high of $240. Support levels are observed near $190, while resistance is projected at $260 based on Fibonacci retracement analysis. The combination of a bullish trend and the company’s robust fundamentals suggests that L3Harris could serve as a dependable floor during periods of market stress.

Risks and Mitigating Factors

No investment is without risk, and L3Harris faces several potential headwinds. The firm’s heavy reliance on government contracts exposes it to policy shifts; any significant reduction in defense spending could compress revenue growth. Additionally, the company’s supply chain is vulnerable to disruptions from global events, such as semiconductor shortages or shipping delays. However, L3Harris has mitigated these risks through strategic partnerships with multiple suppliers and by maintaining a diversified contract base that spans several geographic regions.

Another risk factor is competition from larger defense contractors such as Raytheon Technologies and Northrop Grumman. Yet L3Harris’s focus on niche, high‑tech solutions—particularly in secure communications and sensor fusion—provides a competitive moat that differentiates it from broader‑spectrum rivals.

Valuation and Outlook

Valuation metrics reinforce the defensive narrative. With a forward price‑to‑earnings ratio of 13×, L3Harris trades below the sector average of 18×, reflecting the market’s perception of its stability. A discounted cash flow model, accounting for projected contract inflows and a 3 % growth rate beyond the next fiscal year, yields a target price of $250, a 14 % upside from current levels. Analysts recommend a “Buy” rating, emphasizing that the stock’s risk‑adjusted return potential is attractive for long‑term, defensive investors.

Conclusion

L3Harris Technologies exemplifies a defensive play that marries stable, government‑backed revenue with forward‑looking growth initiatives. Its diversified product lines, strategic contracts, and disciplined financial management position the company to withstand both market volatility and geopolitical uncertainties. For investors seeking a dependable component in a portfolio that can weather downturns while still delivering incremental upside, L3Harris offers a compelling value proposition.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4841151-l3harris-technologies-defensive-play-on-the-move ]