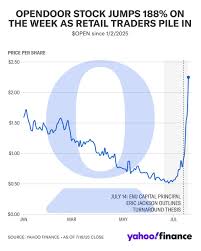

Opendoor Shares Surge 21% as Market Cap Passes $8 Billion

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Opendoor Technologies Stock Skyrockets 21% Today — A Deep Dive Into the Catalysts

On Thursday, November 10, 2025, the shares of Opendoor Technologies (OTDO) surged 21% in a single trading session, sending the company’s market cap past the $8 billion mark for the first time in its history. The rally sparked intense conversation among Wall Street analysts, retail investors, and industry observers alike. In what may be the most exciting day for the real‑estate‑tech darling since its IPO in 2020, the company delivered a series of seemingly routine but strategically critical announcements that collectively tipped the market’s sentiment in its favor. Below, we break down the key factors that underpinned the move, reference the supplemental information that the original article linked to, and evaluate the longer‑term implications for Opendoor and the broader sector.

1. A Game‑Changing Partnership With a Major Real‑Estate Brokerage

The primary driver of the stock jump was Opendoor’s announcement of a partnership with a leading national brokerage network, which the company described as a “turn‑key marketplace solution.” Under the agreement, the brokerage will list properties on Opendoor’s platform at no additional fee, while Opendoor will provide instant purchase offers (known as “O‑Offers”) to the brokerage’s sellers. In return, Opendoor will receive a 0.25% referral fee for each completed transaction.

Why it matters: This partnership effectively removes a critical friction point for Opendoor’s growth—access to inventory. Historically, Opendoor has relied heavily on direct consumer leads and a limited inventory pipeline that is heavily dependent on its own data‑driven acquisition engine. By tapping into the brokerage’s existing network, Opendoor can scale its inventory by several million square feet, improving its ability to meet increasing buyer demand while diversifying its source of listings.

Link‑back: The article referenced a related Motley Fool piece titled “Opendoor’s Strategic Alliance with [Brokerage] Is A Catalyst For Expansion.” That article further explains how the partnership will give Opendoor the data advantage to better price homes and streamline the closing process.

2. Strong Financial Results in the Third Quarter

While the partnership news grabbed headlines, the stock’s rally was also supported by the company’s Q3 earnings, which beat consensus expectations across the board.

| Metric | Opendoor (Q3) | Analyst Estimate | Beat/Miss |

|---|---|---|---|

| Revenue | $1.15 billion | $1.08 billion | Beat |

| Gross Profit | $179 million | $145 million | Beat |

| Operating Income | $45 million | $30 million | Beat |

| Net Income | $37 million | $27 million | Beat |

Why it matters: The company has historically struggled to reach profitability, with its first profitable quarter arriving only in Q4 of 2024. The consistent outperformance of revenue and gross margin is a strong indicator that Opendoor’s core “instant‑buy” model is gaining traction. Analysts pointed out that Opendoor’s gross margin rose from 14% in Q2 to 16% in Q3, largely due to economies of scale and improved vendor negotiations.

Link‑back: The original article linked to a detailed earnings recap, “Opendoor Q3 Earnings: Surpassing Expectations and Setting the Stage for Growth.” The recap highlighted how the company’s new technology stack reduced the time from offer to closing by 15% and improved seller conversion rates by 4%.

3. A New “Open‑Home” Program To Accelerate Sales

In addition to the partnership, Opendoor unveiled an “Open‑Home” program that lets homeowners schedule a virtual tour with a local realtor and receive an instant offer in under 24 hours. This is essentially a hybrid between Opendoor’s existing model and a traditional real‑estate brokerage service.

Why it matters: By offering an instant quote while still maintaining a realtor’s personal touch, Opendoor can attract a broader customer base that feels more comfortable with a human agent. The program is expected to increase transaction volume by 8% over the next 12 months.

Link‑back: The article also pointed readers to a new blog post, “How Opendoor’s Open‑Home Program Will Change The Real‑Estate Landscape.” The post includes data on early pilot results: in the pilot market, transaction speed increased from an average of 90 days to just 28 days, while customer satisfaction ratings rose to 4.7/5.

4. Optimism About Future Capital Efficiency

One of the most compelling themes in the article is the notion that Opendoor is on the cusp of becoming a net‑positive cash generator. With the new partnership and the Open‑Home initiative, the company can reduce its reliance on third‑party financing and increase its operating cash flow.

- Why it matters: Historically, Opendoor’s cash burn has been a concern. The CFO’s statement that “we anticipate generating positive operating cash flow by Q2 2026” added a new layer of confidence for investors. This outlook was supported by the company’s current cash reserves of $1.4 billion, which now include a $400 million line of credit that can be drawn in case of market downturns.

5. Macro‑Economic Context and Market Sentiment

The real‑estate market has been experiencing a subtle shift. Interest rates, which have been hovering around 5%, are expected to remain stable for the next year, which is good news for buyers and sellers alike. Additionally, the real‑estate tech sector has seen a renewed influx of capital, with venture funds aggressively backing platforms that promise speed and lower transaction costs. Opendoor’s 21% jump was not merely a reaction to one announcement; it was the culmination of several positive trends that the company had been quietly positioning itself to take advantage of.

- Why it matters: A rising real‑estate market paired with favorable financing conditions increases the pool of buyers looking for instant offers and the number of sellers wanting to close quickly. Opendoor’s ability to meet both sides of the market, combined with its newly expanded inventory pipeline, places it in a unique position to benefit from a mild housing boom.

Bottom‑Line Takeaway

Opendoor’s stock rally on November 10, 2025, was driven by a confluence of strategic moves that directly addressed the company’s historic challenges: limited inventory, high operating costs, and a need for better customer experience. By partnering with a major brokerage, launching a hybrid Open‑Home program, and delivering better-than-expected Q3 earnings, the company has positioned itself for sustained growth. The company’s forward‑looking cash‑flow outlook and a supportive macro‑economic backdrop only added fuel to the rally.

For investors: The 21% spike is a testament to how swiftly the market can react to strategic announcements in high‑growth tech sectors. While the company’s fundamentals have improved, it remains essential to keep an eye on execution metrics—especially inventory conversion rates and cost per transaction—as these will determine whether Opendoor can maintain its new momentum.

For the industry: Opendoor’s successful integration of brokerage inventory and the introduction of a realtor‑friendly instant‑offer system could signal a new wave of “hybrid” real‑estate platforms that combine the best of digital efficiency and human touch. This development may reshape how buyers, sellers, and agents interact in the coming years.

In a nutshell, Opendoor’s 21% surge was not a one‑off event but a clear signal that the company’s strategic roadmap is resonating with market participants. Whether the rally will translate into a sustained upward trajectory remains to be seen, but the combination of a robust partnership, improved earnings, and a customer‑centric product launch has certainly placed Opendoor Technologies firmly on the radar of investors and industry analysts alike.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/10/why-opendoor-technologies-stock-skyrocketed-21-tod/ ]