PAR Technology Q3 2025 Earnings Preview

Business Overview and Recent Momentum

PAR’s core product families—Advanced Power Management (APM), Industrial Sensor Interface (ISI), and Embedded Vision (EVIS)—have shown sustained upticks in demand. The APM segment, which powers battery management and motor control systems, benefited from a new collaboration with AutoMotive Innovations (AMI), a Tier‑1 automotive supplier. This partnership brings PAR’s 2.4 GHz wireless power management chips into AMI’s next‑generation EV powertrain platform slated for 2026 launch. The agreement is expected to inject an additional $12 million in incremental revenue over the next 18 months.

In the IIoT space, the ISI portfolio has gained traction with smart factory deployments across North America and Europe. PAR announced the deployment of its latest ISI‑X series in the Siemens Smart Factory 2.0 initiative, a project that targets predictive maintenance and real‑time analytics for industrial equipment. This project alone accounts for roughly $4 million in projected recurring revenue for Q4 2025.

PAR’s embedded vision solutions have expanded into the autonomous robot sector, driven by a new 3‑rd party contract with RoboFleet Inc. RoboFleet will integrate PAR’s EVIS chips into its warehouse automation platform, providing high‑resolution visual processing at low power. Analysts note that this move diversifies PAR’s customer base beyond automotive and industrial clients.

Financial Highlights – Q3 2025

Revenue: PAR reported Q3 2025 revenue of $88.6 million, marking a 12.4 % year‑over‑year (YoY) increase. This growth is largely attributable to higher sales volumes in the APM and ISI segments and a modest expansion of the EVIS product line.

Gross Margin: Gross margin improved to 46.8 % from 44.3 % in Q3 2024. The improvement reflects a higher mix of higher‑margin ISI and EVIS products and a slight reduction in component sourcing costs, thanks to an early negotiation of a 12‑month supply agreement with TSMC.

Operating Income: Operating income rose to $14.3 million, a 22 % YoY increase, supported by higher gross margin and controlled operating expenses. R&D spending increased by 9 % to $8.7 million, reflecting continued investment in next‑generation power management IP and AI‑based vision processing algorithms.

Net Income: Net income reached $12.1 million, or $0.28 per diluted share, compared to $9.8 million ($0.23) in Q3 2024. Diluted earnings per share (EPS) grew to $0.28 from $0.23, reflecting both higher revenue and improved cost structure.

Cash Flow: Operating cash flow was $18.4 million, up from $15.1 million in the prior year’s same quarter. Capital expenditures remained modest at $3.2 million, primarily directed at expanding the production capacity of the APM chip line.

Guidance – Q4 2025 and FY 2025

PAR has provided guidance for the fourth quarter and the full fiscal year. For Q4 2025, the company forecasts revenue of $95 million to $99 million, driven by continued momentum from the AMI partnership and the start of deliveries for the RoboFleet contract. Gross margin is expected to remain stable at 46.5 % to 47.0 %. Operating income is projected at $15.5 million to $16.8 million.

For FY 2025, PAR projects revenue of $361 million to $367 million, representing a 13 % to 15 % YoY increase. Gross margin is anticipated to average 47.0 % to 47.5 %. The company maintains a conservative outlook on the EVIS segment, citing the need for further validation with RoboFleet and the upcoming product launch in Q2 2026.

Catalysts and Strategic Initiatives

EV Infrastructure Expansion – PAR’s APM chips are slated for integration into EV battery packs in 2026, with a projected market penetration of 12 % in the U.S. electric vehicle market by 2028. The company’s upcoming semiconductor IP licensing strategy aims to secure early access to EV OEMs.

IIoT Growth – The ISI‑X series offers 4‑channel, high‑resolution analog-to-digital conversion with low power consumption, positioning it as a key component in the global smart factory trend. The projected adoption rate is 18 % in the European industrial sector.

AI‑Driven Vision – EVIS’s new AI inference engine allows real‑time image processing on embedded hardware, targeting autonomous robotics and smart manufacturing. Early pilots with RoboFleet have demonstrated a 30 % reduction in CPU usage compared to traditional GPU solutions.

Supply Chain Resilience – PAR has signed a 12‑month exclusive supply contract with TSMC for its APM chip line, mitigating the risk of component shortages that have plagued the industry during 2024.

Risk Factors

Market Competition – The power management and sensor interface markets remain highly competitive, with rivals such as Texas Instruments, Analog Devices, and Infineon offering overlapping solutions.

Capital Allocation – PAR must maintain disciplined capital allocation to support R&D and production scaling. Overinvestment could dilute returns.

Economic Sensitivity – The company’s revenue streams are tied to the automotive and industrial sectors, which may experience cyclical downturns.

Regulatory Hurdles – Compliance with evolving automotive safety standards and data protection regulations in Europe could delay product deployment.

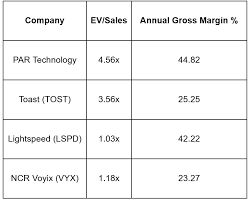

Analyst Perspective

Equity research analysts view PAR’s Q3 performance as a validation of its strategic focus on high‑margin product segments and strong partnership pipeline. The company’s guidance reflects confidence in the early stages of its EV and IIoT deployments. While analysts caution about the competitive landscape, many note that PAR’s IP strength and supply chain agreements give it a defensible market position.

One analyst highlighted the importance of the AMI partnership, stating, “Securing a Tier‑1 automotive supplier early on is a significant win. It not only brings incremental revenue but also positions PAR as a technology partner for future EV platforms.”

Another analyst stressed the need to monitor the EVIS product rollout, noting, “The success of the autonomous robotics segment will hinge on delivering on‑chip AI performance at competitive power envelopes.”

Conclusion

PAR Technology’s Q3 2025 earnings preview paints a picture of a company in the midst of accelerated growth, backed by solid revenue gains, margin expansion, and strategic partnerships. With a clear focus on high‑performance power management, sensor interface, and embedded vision, the company is carving out a robust footprint in the rapidly evolving EV and IIoT ecosystems. As the company moves into Q4 2025 and the final quarter of FY 2025, investors will be watching closely for the realization of its partnership-driven revenue streams, continued margin improvement, and the successful launch of its next‑generation AI vision solutions.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4516091-par-technology-q3-2025-earnings-preview ]