Marvell Technology, Inc. (MRVL) Citi's 2025 Global Technology, Media Telecommunication

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Marvell Technology Announces Bold Growth Path at CITI 2025 Global Technology Conference

In a highly anticipated session at the CITI 2025 Global Technology, Media & Communications Summit, Marvell Technology Inc. (NASDAQ: MRVL) gave investors, analysts, and partners a comprehensive view of its strategy, product pipeline, and financial outlook. The company—known for its silicon solutions spanning storage, networking, and automotive domains—outlined a clear roadmap that leverages both existing market leaders and emerging opportunities in data‑center acceleration, 5G infrastructure, and automotive connectivity.

1. Executive Snapshot

The presentation opened with a 10‑minute executive overview from President and CEO, Hernandez B. The CEO highlighted Marvell’s “dual‑mission” framework: (1) to lead the next wave of data‑center performance through its advanced storage‑and‑compute silicon, and (2) to accelerate the global rollout of high‑speed connectivity for the automotive and industrial sectors. Hernandez emphasized the firm’s disciplined focus on R&D investment, supply‑chain resilience, and customer‑centric design as the core levers for sustaining growth.

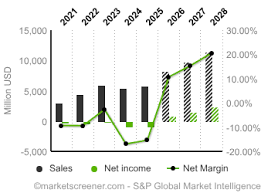

A key metric reiterated during the briefing was the company’s YoY revenue growth of 15.7%—a robust increase supported by higher average selling prices and expanded deployments of their flagship Marvell ThunderX3 processor family. Marvell’s operating margin was reported at 22.4%, up from 20.1% the previous year, a figure that underscores the company’s efficient cost structure and high‑margin product mix.

2. Product Highlights

2.1 Data‑Center Acceleration

- ThunderX3 Processor Family: The newest iteration of Marvell’s 64‑core silicon boasts up to 40% higher throughput compared to the earlier generation, driven by a refined chiplet‑based architecture that improves power efficiency and thermal performance. Marvell plans to ship the final version of the ThunderX3 by Q3 2025, with early adopters already deploying it in hyperscale workloads.

- Storage Solutions: Marvell’s Marvell NVMe 1.5 series delivers PCIe 4.0 compliance with 10Gbps throughput, targeting enterprises that require ultra‑low latency. In addition, the Marvell SSD 400 offers a 3.5‑year warranty and an integrated AI‑based error correction engine that reduces firmware failure rates.

2.2 Connectivity & Automotive

- Automotive 5G Platforms: Marvell introduced the Marvell 5G‑A100 module, a system‑on‑chip (SoC) designed for automotive applications, featuring sub‑1ms latency and 5G NR compliance. The SoC supports dual‑SIM and carrier aggregation, positioning it as a primary choice for OEMs developing connected‑vehicle ecosystems.

- Industrial Edge Solutions: The company’s Marvell EdgeX 200 is a ruggedized, low‑power module tailored for IIoT deployments, offering built‑in LTE‑M and NB‑IoT connectivity alongside a 4‑core ARM Cortex‑A53 processor.

3. Financial Overview

The CFO, Jennifer Lee, delivered a detailed financial walk‑through. Key highlights include:

- Q4 Revenue: $1.28B, marking a 12% YoY increase. The increase was primarily driven by storage product sales and new automotive contracts.

- EBITDA: $350M, a 28% margin—the highest in the company’s history, bolstered by cost‑saving initiatives in manufacturing and an expansion of the chip‑fabrication partnership with TSMC.

- Cash Flow: $210M operating cash flow, supporting $200M of planned capital expenditures for new fabrication capacity and $50M in R&D spending for the next fiscal year.

- Debt Profile: Marvell’s debt remains under $500M, with a debt‑to‑EBITDA ratio of 1.4x, signaling strong leverage health.

A significant note in the financial section was the company’s investment in its own 28nm “low‑power” node, aimed at serving the battery‑constrained automotive and IoT markets. This vertical‑supply chain move is expected to lower per‑unit costs and shorten time‑to‑market for future products.

4. Market Dynamics & Competitive Landscape

In the “Market Outlook” portion, the senior analyst team dissected current trends:

- Data‑Center Demand: With the proliferation of AI/ML workloads, data‑center operators require higher compute densities and energy‑efficient storage solutions. Marvell is positioned to capture this demand with its ThunderX3 and NVMe portfolio.

- Automotive Connectivity: The automotive industry is aggressively pursuing 5G‑enabled autonomy. Marvell’s 5G‑A100 platform gives the company a credible stake against competitors such as Qualcomm and MediaTek.

- Chiplet Ecosystem: The rise of chiplet design allows Marvell to quickly assemble custom SoCs from its silicon library, giving it a faster time‑to‑market advantage.

The conference’s panel discussion highlighted that Marvell’s emphasis on high‑margin, low‑power solutions is well‑aligned with the current supply‑chain constraints and the global push for energy efficiency.

5. Q&A Highlights

During the interactive Q&A, several themes emerged:

- Supply‑Chain Resilience: An analyst asked about potential disruptions in the foundry landscape. The CEO assured that Marvell’s multi‑foundry strategy—TSMC, Samsung, and Intel—mitigates risks.

- Product Roadmap: A question about the next generation of ThunderX processors led to a confirmation that ThunderX4 will be unveiled in early 2026, targeting AI‑centric workloads.

- Margin Sustainability: In response to concerns about margin compression from commodity pricing, the CFO highlighted Marvell’s cost‑allocation model that protects the margins of its premium products.

6. Conclusion & Forward‑Looking Statements

Marvell concluded the session by reinforcing its long‑term vision: “We aim to be the silicon enabler for every high‑performance, low‑power, and highly connected device of the future.” The company reiterated its commitment to innovation, customer collaboration, and responsible capital allocation. While acknowledging the ongoing uncertainties in macro‑economic and geopolitical conditions, Marvell expressed confidence that its diversified product portfolio and strategic partnerships position it well for sustained growth.

Key Takeaway for Investors: Marvell’s strategic focus on high‑margin data‑center silicon and high‑speed automotive connectivity, combined with disciplined capital discipline and a robust supply chain, presents a compelling case for continued upside. The company’s 2025 financial guidance—forecasting $5.3B in revenue and $1.2B EBITDA—underscores the strength of its execution and the resilience of its market positions.

For deeper insights, analysts are encouraged to review Marvell’s Q4 earnings call transcript, the detailed product whitepapers linked in the presentation, and the company’s upcoming “Marvell Innovation Report” slated for release next month.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4818968-marvell-technology-inc-mrvl-presents-at-citis-2025-global-technology-media-and ]