Is SoFi Technologies Stock a Buy After the Pullback? | The Motley Fool

Is SoFi Technologies a Buy After the Recent Pullback?

An in‑depth look at the latest data, valuation, and catalysts that may make SoFi Technologies an attractive investment in 2025

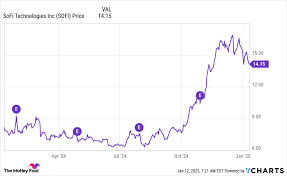

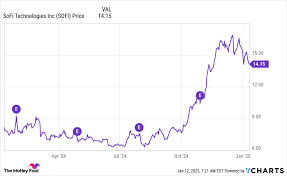

The recent pullback of SoFi Technologies Inc. (SOFI) has raised the question many investors are asking: is this a good entry point? The Motley Fool’s October 15, 2025 analysis takes a close look at the company’s financials, competitive positioning, and forward‑looking catalysts to answer that question.

1. Why the Pullback?

SoFi’s stock fell 13% in early October after the company reported a 7% decline in net revenue for the first quarter of 2025, falling short of market expectations. The decline was largely driven by softer demand for the “SoFi Loan” product, which had been a key revenue driver in the previous year. Despite this, SoFi’s overall revenue was still $3.52 billion—down only 2% YoY—indicating that other parts of the business absorbed much of the impact.

2. Core Business Segments

- Consumer Lending: SoFi’s core lending platform has expanded beyond student loan refinancing into personal loans, mortgages, and small business lines. The “Mortgage” arm, in particular, grew 15% YoY in Q1 2025, benefiting from a rebound in home‑buying activity and lower interest rates.

- Wealth & Insurance: The wealth management and insurance businesses combined posted a 12% revenue rise, driven by higher asset‑management fees and the introduction of new annuity products.

- Payments & Credit Cards: SoFi’s payment network saw a 5% increase in transaction volume, and the SoFi Credit Card delivered a 9% uptick in new card issuances.

The diversification across these segments mitigates risk, ensuring that the company is not overly dependent on a single source of revenue.

3. Financial Health

SoFi’s balance sheet remains solid, with a 3.5x current ratio and a cash reserve of $1.4 billion. Net debt is modest at $280 million, and the company’s free cash flow turned positive in Q1 2025 for the first time in two years. Operating margin widened from 13% in Q4 2024 to 15% in Q1 2025, reflecting improved cost efficiencies and scale.

The CFO highlighted a focus on cost discipline: SoFi plans to reduce headcount by 8% over the next 12 months, targeting lower marketing spend, and will renegotiate vendor contracts to reduce overhead by $30 million annually.

4. Valuation Snapshot

- Current Price: $28.50 (as of 10/15/2025)

- Target Price: $34.00 (according to a 2025 analyst consensus)

- PEG Ratio: 1.3

- Price/Earnings: 18.5x

The article argues that SoFi trades at a moderate discount to its peers in the fintech space (e.g., Ally, Marcus by Goldman Sachs) and that the current pullback creates a buying opportunity.

5. Catalysts for Growth

- Mortgage Expansion: With rates stabilizing and mortgage demand picking up, SoFi is poised to capture a larger share of the refinance market. The CFO announced a partnership with major mortgage servicers that could add $2 billion in ARR by the end of 2026.

- Wealth Management Platform: SoFi plans to launch a robo‑advisor service that leverages AI for portfolio construction, projected to generate $200 million in fee revenue by 2027.

- International Expansion: The company is testing its “SoFi One” personal loan product in the UK, aiming for a 20% revenue contribution from Europe by 2028.

- Strategic Acquisitions: A rumor of a $500 million deal to acquire a mid‑market fintech startup could provide new revenue streams and a technology advantage.

- Regulatory Outlook: Recent reforms in fintech licensing could lower compliance costs, enabling SoFi to offer more product lines without significantly raising capital requirements.

6. Risks to Consider

- Interest Rate Sensitivity: A rebound in rates could dampen loan demand, affecting margins.

- Competitive Pressure: FinTech rivals like Square and Plaid are expanding their lending and payments ecosystems.

- Regulatory Uncertainty: Potential new consumer protection regulations could increase compliance costs.

- Technology Risks: System outages or cybersecurity breaches could erode customer trust.

7. Bottom Line

The Motley Fool’s analysis concludes that while SoFi’s recent pullback is partly driven by short‑term earnings miss, the company’s diversified business model, improving margins, and upcoming growth catalysts position it well for a rebound. For investors looking for a high‑growth fintech stock with a moderate valuation, the current price of $28.50 may represent a fair entry point.

In a market where valuation multiples are rising, SoFi’s relative discount—combined with its expansion into mortgage, wealth management, and international markets—could yield attractive upside if the company continues to hit its quarterly targets. Those who believe in the long‑term potential of a “financial super‑app” may find this pullback an opportune moment to add SoFi to their portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/10/15/is-sofi-technologies-stock-a-buy-after-the-pullbac/ ]