Biotechnology: Pioneering The Future Of Medicine

Biotechnology: Pioneering the Future of Medicine

The biotechnology sector continues to redefine the therapeutic landscape, weaving together cutting‑edge science with a rapidly evolving regulatory and investment environment. An in‑depth analysis of the Seeking Alpha article “Biotechnology: Pioneering the Future of Medicine” (article ID 4836862) reveals how a confluence of genomic editing, RNA‑based platforms, and cell‑therapy innovations is reshaping both patient outcomes and investor strategies. The piece chronicles the current momentum in biotech, highlights breakthrough therapies in late‑stage clinical development, and delineates the strategic choices that companies face as they navigate a crowded and highly regulated market.

1. The Strategic Landscape of Modern Biotech

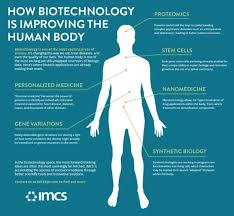

The article begins by framing biotech as the cornerstone of future medicine, propelled by advances that extend life expectancy, improve quality of life, and unlock new therapeutic modalities. A key narrative thread is the acceleration of translational research: from genome‑wide association studies to high‑throughput screening, biotech firms now can move from a genetic discovery to a clinical candidate in a fraction of the time traditionally required.

Key takeaways:

Diversification of Funding Sources: Traditional venture capital is supplemented by public‑private partnerships, philanthropy, and large pharmaceutical collaborations. The infusion of capital has enabled smaller firms to invest heavily in early‑stage research, thereby expanding the pipeline of potential blockbuster drugs.

Regulatory Evolution: The FDA’s adaptive trial designs and real‑world evidence requirements are shortening development timelines. The article cites specific approvals, such as the expedited clearance of the first CRISPR‑based therapy, as proof of a regulatory climate increasingly receptive to transformative technologies.

Global Competition: While the United States remains a leader, the piece notes significant contributions from European, Asian, and emerging markets. Companies in Japan, China, and Israel are making strides in mRNA therapeutics and cell‑engineering platforms, broadening the competitive map.

2. Breakthrough Technologies Underway

2.1 RNA‑Based Platforms

The narrative underscores the success of mRNA vaccines during the COVID‑19 pandemic and pivots to their expanding therapeutic potential. The article references Moderna’s mRNA‑based cancer immunotherapies, which are currently in phase III trials, and BioNTech’s oncology pipeline, which is integrating neo‑antigen discovery with personalized vaccine delivery. The discussion includes the technical nuance of lipid nanoparticle formulations, improved stability, and targeted delivery—key hurdles that are now being overcome.

2.2 Gene Editing and Gene Therapy

CRISPR‑Cas9 technology is highlighted as a game‑changer for treating monogenic disorders. The article cites the FDA approval of CT‑GCV, a CRISPR‑based therapy for sickle cell disease, and the clinical trials of Editas Medicine’s GLOBE platform for Leber congenital amaurosis. These examples illustrate the shift from proof‑of‑concept to viable, market‑ready treatments.

2.3 Cellular Therapies

Chimeric antigen receptor (CAR) T‑cell therapies continue to revolutionize oncology. The article reviews the expansion of CAR‑T products beyond hematologic malignancies into solid tumors, noting early successes in targeting HER2‑positive breast cancer. It also highlights the development of “off‑the‑shelf” allogeneic CAR‑T platforms by companies such as Allogene Therapeutics and Celyad, aiming to reduce manufacturing complexity and cost.

2.4 Precision Medicine and Diagnostics

Beyond therapeutics, biotech is advancing diagnostics that enable truly personalized care. The article discusses the rise of liquid biopsy technologies, which allow for non‑invasive monitoring of tumor evolution and early detection of recurrence. It also explores AI‑driven genomics platforms that can predict drug response, thereby informing treatment selection.

3. Investor Outlook and Market Dynamics

The article dedicates a substantial section to the financial ramifications of these scientific advances. It points out that the average valuation of biotech firms at market entry has risen, driven by both higher expected returns and greater public confidence in the pipeline.

3.1 Valuation Metrics

Revenue Projections: Companies like CRISPR Therapeutics and Editas are projected to surpass $200 million in sales by 2026, reflecting a 25‑30 % CAGR in the sector.

Profitability Trajectories: The article notes that most biotech firms are still operating at a loss, but the path to profitability is becoming clearer as patents expire and generic competition is delayed by unique delivery mechanisms.

3.2 Risk Factors

Regulatory Delays: Despite streamlined pathways, the risk of adverse events or unforeseen side effects can still derail approvals.

Manufacturing Challenges: Scaling up production of cell‑based therapies remains a bottleneck, with limited manufacturing capacity potentially stalling product launch.

Patent Landscape: The complex web of overlapping patents in CRISPR technology can lead to costly litigation, affecting company valuations.

3.3 Strategic M&A and Partnerships

The article lists several high‑profile mergers, such as the partnership between GSK and Novartis to combine mRNA expertise with a strong oncology portfolio. These alliances are portrayed as essential for companies seeking to accelerate their pipeline while sharing development costs.

4. Key Takeaways for Stakeholders

Therapeutic Diversity: The convergence of mRNA, gene editing, and cellular platforms is creating a diversified portfolio of high‑impact therapies, reducing the concentration risk in any single modality.

Accelerated Development: Regulatory innovations and real‑world data integration are shrinking the typical 10‑year drug development cycle to 5–7 years for certain indications.

Capital Landscape: With a more favorable risk‑reward profile, biotech remains an attractive class for venture funds, private equity, and public markets alike.

Strategic Positioning: Companies that can secure early access to proprietary delivery systems, or who can form strategic alliances with large pharma, will likely capture the largest market share.

Long‑Term Horizon: While early‑stage companies face significant risk, the sector’s overall trajectory points toward a future where many diseases—once considered intractable—may become manageable or curable.

5. Concluding Thoughts

The Seeking Alpha analysis paints a compelling picture of a biotech industry in the throes of transformation. Breakthroughs in RNA therapeutics, CRISPR gene editing, and CAR‑T cell therapies are not merely incremental improvements; they represent paradigm shifts that re‑define disease treatment. For investors, the key lies in discerning which companies possess not only a strong scientific foundation but also the operational acumen and strategic partnerships to bring those discoveries to market.

As the sector continues to evolve, the interplay between science, regulation, and capital will determine the pace at which these innovations reach patients. The article’s synthesis of current developments, combined with its forward‑looking commentary, provides a valuable roadmap for anyone seeking to understand how biotechnology is pioneering the future of medicine.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4836862-biotechnology-pioneering-future-medicine ]