How Financial Technologies Are Reshaping Latin American Finance

How Financial Technologies Are Reshaping Latin American Finance

(Forbes Business Council, September 29 2025)

The Latin‑American financial landscape has entered a phase of rapid, technology‑driven transformation. The Forbes Business Council piece traces how a combination of mobile‑first banking, regulatory sandboxes, and cross‑border fintech ecosystems is redefining access, affordability, and resilience across the region. Below is a detailed summary of the article’s key points, the trends it highlights, and the broader context it places Latin America’s fintech boom within.

1. A Region on the Verge of Digital Banking Mass‑Adoption

- Mobile‑First Momentum: Latin America has the highest mobile‑phone penetration per adult in the world, and this infrastructure is a catalyst for digital‑first financial services. The article underscores that over 80 % of the region’s population now carries a smartphone, enabling seamless integration of banking apps, payment wallets, and micro‑credit platforms.

- The Rise of “Neobanks” and “Digital Banks”: Firms such as Brazil’s Nubank, Mexico’s Clip, Argentina’s Ualá, and Colombia’s Davivienda Digital have become household names. These players use lightweight, cloud‑based architectures to offer credit, savings, and payment products without the need for brick‑and‑mortar branches. By 2025, Forbes cites that digital banks will handle roughly 30 % of all debit‑card transactions in the region, a jump from the 8 % figure reported in 2020.

- Regulatory Flexibility: The article points out that several Latin‑American regulators have created regulatory sandboxes to experiment with fintech innovations in a controlled environment. For example, Mexico’s “FinTech Lab” and Chile’s “Open Finance Sandbox” allow firms to test new products while maintaining oversight of consumer protection.

2. FinTech as a Tool for Financial Inclusion

- Micro‑Credit & Alternative Lending: FinTech platforms use alternative data—social media engagement, mobile‑phone usage, even utility bill payments—to generate credit scores for people traditionally excluded from conventional banking. The article cites the success of Argentine fintech Creditas and Colombian lender Konfío, which have processed tens of millions of dollars in credit to underserved SMEs.

- Remittances and Cross‑Border Payments: Remittance flows from the United States and Europe into Latin America were estimated at $65 billion in 2024. Traditional money‑transfer services still dominate, but the article discusses how fintech players like Remitly and MercadoPago have lowered fees by 30–40 % and cut transfer times from days to minutes. A notable example is Skrill’s partnership with Banco de Chile to launch a digital remittance app targeting the Bolivian diaspora in Chile.

- Digital Savings & Micro‑Investments: The article highlights the popularity of “round‑up” savings apps—such as Kubo Financiero in Mexico—that automatically transfer spare change from everyday purchases into savings accounts. This simple mechanic has been credited with raising the average savings rate among young adults from 4 % to 9 % over the past two years.

3. The Role of Emerging Technologies

- Artificial Intelligence & Machine Learning: The article explains how AI is being leveraged for fraud detection, credit risk assessment, and customer support. For instance, Banco Inter in Brazil uses machine‑learning models that analyze transaction patterns to flag suspicious activity in real time.

- Blockchain & Distributed Ledger Tech: While still nascent in the region, blockchain is used for cross‑border settlement and transparent supply‑chain finance. Deloitte has reported that Brazilian fintech Cielo piloted a blockchain‑based payment network for small‑to‑medium‑enterprise (SME) invoicing in 2024.

- Biometric Authentication: In countries with lower levels of digital identity infrastructure, biometric methods (fingerprint, facial recognition) are being integrated into mobile banking apps to reduce identity fraud. The article cites Colombia’s NeuroBank, which uses facial recognition to open accounts without a physical ID.

4. Challenges and Risks

- Cybersecurity Threats: With the surge in digital transactions, the article highlights a concurrent rise in cyber‑attacks targeting fintech platforms. It cites a 15 % year‑over‑year increase in reported phishing incidents across the region.

- Regulatory Fragmentation: While sandboxes are encouraging experimentation, the lack of harmonized regulations across borders can create uncertainty for cross‑border fintech operators. The piece calls for a regional regulatory framework to streamline licensing and compliance.

- Digital Divide & Infrastructure Gaps: Despite high smartphone penetration, internet access in rural areas remains spotty. The article notes that 17 % of the population in remote Mexican communities still experience unreliable connectivity, limiting the reach of mobile banking.

5. Looking Ahead: Projections and Strategic Recommendations

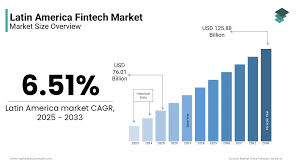

- Growth Forecasts: Forbes’ research cited in the article projects the Latin‑American fintech market to grow at a CAGR of 22 % from 2025 to 2030, reaching an estimated $110 billion in total transaction value by 2030. The article emphasizes that this growth is contingent on sustained consumer trust, robust data protection laws, and continued investment in fintech infrastructure.

- Strategic Partnerships: The piece recommends that traditional banks forge joint ventures with fintech startups to combine capital and brand credibility with agility and tech‑savvy product design. For example, the partnership between BBVA and Kredit Suisse in Chile is highlighted as a successful model.

- Policy Implications: The article urges policymakers to expand financial literacy programs and improve digital identity systems, noting that a well‑educated, digitally literate populace will accelerate fintech adoption.

6. Additional Resources and Linked Articles

The Forbes article links to several supporting pieces that provide deeper dives into specific topics:

- “FinTech Investment Trends in Latin America” – A data‑rich analysis of VC funding flows, highlighting key investors such as SoftBank’s Vision Fund and local entities like BMG.

- “Open Banking in Latin America: A Comparative Study” – An overview of how open‑banking APIs are being adopted in Brazil, Mexico, and Colombia, with case studies on Banco Inter and BBVA México.

- “Regulatory Sandboxes: A Global Perspective” – A comparative look at sandbox frameworks in the United States, United Kingdom, and Singapore, with implications for Latin‑American regulators.

- “Remittances in the Digital Age” – A broader discussion on the socio‑economic impact of remittances, featuring interviews with migrants and bank officials.

Each of these linked articles adds nuance to the central narrative: that technology is not simply a tool but a catalyst for systemic change across the region’s financial ecosystems.

Bottom Line

Latin America’s financial future is increasingly digital. The Forbes Business Council article provides a comprehensive snapshot of how mobile‑first banking, regulatory experimentation, and emerging technologies are democratizing access to credit, savings, and cross‑border payments. It also cautions that the industry must address cybersecurity, regulatory harmonization, and digital infrastructure gaps to sustain momentum. For stakeholders—banks, fintech entrepreneurs, regulators, and investors—the key takeaway is clear: collaboration and innovation are essential to unlock the full potential of a region that already stands at the forefront of mobile connectivity.

Read the Full Forbes Article at:

[ https://www.forbes.com/councils/forbesbusinesscouncil/2025/09/29/how-financial-technologies-are-reshaping-latin-american-finance/ ]