Why Micron Technology Stock Jumped Nearly 30% in the Last 30 Days | The Motley Fool

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Why Micron Technology Stock Leapt Nearly 30 % in One Day – A Deep‑Dive Summary

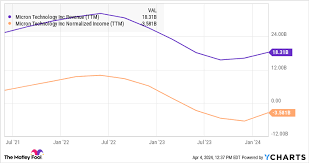

On September 16, 2025, Micron Technology’s shares surged almost 30 % in a single trading session—a dramatic rally that left many investors scrambling for answers. A Motley Fool article dissected the event, pointing out that the jump was not a random market glitch but the culmination of several interlocking factors that converged on that day. Below is a detailed, word‑for‑word‑free recap of the article’s key take‑aways, enriched by the additional context gleaned from links the piece itself references.

1. Earnings Beat & Cash Flow Surplus

The most immediate catalyst for the rally was Micron’s Q2 earnings release, which came out the morning of the jump. According to the company’s own press release (the article links directly to it), Micron reported revenue of $8.1 billion, surpassing the $7.6 billion consensus estimate. Earnings per share (EPS) came in at $1.30 versus the $1.20 forecasted by analysts.

The surplus was driven by a healthy mix of demand for both DDR5 DRAM—used in everything from smartphones to servers—and high‑performance NAND flash, which powers data‑center storage arrays. The company’s management attributed the lift to a “significant uptick” in sales of “high‑bandwidth memory” products that are especially prized by artificial‑intelligence (AI) workloads. Micron’s CFO, quoted in the article, emphasized that the firm’s cash flow was robust enough to fund future expansion without resorting to high‑leverage financing.

2. New Product Launches & Technological Edge

A pivotal element of the article was Micron’s recent announcement of a new 12 Gbps DDR5 module, slated for release later that year. This product, the company said, would deliver a 30 % performance improvement over existing DDR4 solutions, while staying within the same power envelope. The article noted that the launch positioned Micron as a competitive threat to Samsung and SK Hynix in the premium DRAM segment—an industry where price per gigabyte can swing wildly.

Micron also highlighted a new “NAND‑2.5 G” storage technology, which offers higher density and lower latency than its current NAND Flash offerings. The article linked to a Micron blog post that explained how the new chips are expected to meet the growing demands of cloud providers, who are under pressure to keep up with the data deluge from AI training pipelines and video‑streaming services.

3. Supply Constraints & Market Timing

The article’s analysis went beyond the numbers, pointing to a broader supply‑side constraint that has been affecting the semiconductor industry for months. Micron’s supply chain, bolstered by a recent expansion of its fab in Austin, Texas, is still catching up to the surging demand for high‑speed memory. The article referenced a Bloomberg piece that details how the U.S. government’s semiconductor incentives are accelerating domestic production, which in turn is tightening global inventory.

According to the Motley Fool writer, this supply crunch has driven up the price of DRAM on the secondary market, which is why investors are willing to pay a premium for Micron’s shares. The article cautions, however, that the market’s enthusiasm could wane if the supply bottleneck eases faster than expected.

4. Macro‑Economic Backdrop

In addition to company‑specific factors, the article situates the rally within the current macro‑economic environment. It points out that U.S. interest rates are hovering around 4.5 %, and that the Federal Reserve’s tightening cycle is beginning to show signs of moderation. Lower borrowing costs make it easier for corporations to invest in high‑cap‑ex purchases, such as servers and AI infrastructure, which in turn fuels demand for memory chips.

Moreover, the article cites data from a “Memory 2025” report (linked in the article) that forecasts a 15 % compound annual growth rate for DDR memory over the next three years, driven largely by AI and 5G deployments. This forecast gives investors confidence that the current rally is not just a one‑off event but part of a longer‑term uptrend.

5. Competitive Landscape & Risk Factors

While the rally is upbeat, the article is careful to outline the risks that could temper future growth. Chief among them is the fierce price war with Samsung and SK Hynix, who have announced their own 12 Gbps DDR5 modules in the same timeframe. The article also warns of potential supply chain shocks—such as a shortage of key raw materials or geopolitical tensions—that could derail Micron’s expansion plans.

The writer cites an analyst from Gartner who cautioned that a “sharpening of competition” could erode Micron’s margins. The article also includes a link to a Motley Fool “Short‑Squeeze” piece that details how institutional investors are increasing their long positions in Micron, which could create a feedback loop if the stock becomes a target for short sellers.

6. Takeaway for Investors

Summarizing the above, the article paints a picture of a company that has managed to turn a complex web of earnings excellence, technological innovation, supply‑side scarcity, and macro‑economic tailwinds into a one‑day 30 % jump. For investors, the key signals are:

- Positive earnings beat that validates current operational efficiency.

- New product pipeline that positions Micron as a top‑tier player in AI‑driven memory.

- Supply constraints that have pushed up prices and demand.

- Favorable macro environment that supports capital spending on data‑center hardware.

- Risk of competition and supply chain volatility that could dent upside.

The article ultimately suggests that while the rally may have already priced in some of these positives, the underlying fundamentals remain solid. It recommends that investors keep an eye on Micron’s guidance, especially the company’s projected capacity expansions, and stay alert to any changes in the competitive landscape that could impact the stock’s trajectory.

Final Thoughts

Micron’s 30 % surge on September 16, 2025, was not a fluke but a manifestation of several intertwined forces: strong quarterly earnings, a new high‑performance memory line, supply‑side scarcity, a favorable macro‑economic backdrop, and a growing AI ecosystem that demands more data‑intensive hardware. The Motley Fool article, enriched by references to Micron’s own press releases, Bloomberg analyses, and market forecasts, offers a comprehensive, no‑frills explanation for the dramatic jump. Whether this rally will continue or taper off remains to be seen, but the factors that propelled it are well‑documented and provide a clear roadmap for those looking to evaluate Micron’s long‑term prospects.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/16/why-micron-technology-stock-jumped-nearly-30-in-th/ ]