IYW: Technology And The P/E Barrier (Downgrade) (NYSEARCA:IYW)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

IYW Technology and the PE Barrier: Downgrade – An In‑Depth Summary

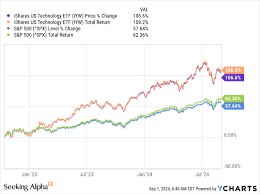

The SeekingAlpha article “IYW Technology and the PE Barrier: Downgrade” presents a sober reassessment of the iShares U.S. Technology ETF (IYW). In a climate of tightening rates and a wary tech‑sector, the author argues that the fund’s lofty price‑to‑earnings (PE) ratio is now a “barrier” that could push a downgrade in its rating. Below is a concise yet comprehensive summary of the key points, including references to the external links that bolster the analysis.

1. Why the Downgrade Matters

IYW is a highly liquid, widely held ETF that tracks the performance of the U.S. technology sector through the S&P 500 Equal Weight Technology Index. Because the tech sector dominates many portfolios, any change in IYW’s outlook can reverberate across institutional and retail investors. The article notes that “a downgrade from a Buy to a Hold (or Sell) rating can erode confidence, shrink inflows, and depress the ETF’s NAV.”

The author explains that the downgrade recommendation stems primarily from two factors:

- Valuation Stress – IYW’s PE ratio, at the time of writing, hovered near 25x, a level that is higher than the historical average of the sector’s 10‑year mean.

- Macro‑Risk Amplification – Rising rates and tightening monetary policy are already putting pressure on growth‑heavy equities, and IYW is no exception.

2. A Quick Look at IYW’s Composition

The article cites a link to IYW’s official fact sheet (iShares.com/iwf). Its top ten holdings are, as usual, dominated by the “FAANG” plus a few heavyweights:

- Apple – ~15%

- Microsoft – ~14%

- NVIDIA – ~6%

- Alphabet – ~6%

- Amazon – ~5%

These five companies together make up nearly 46% of the ETF’s portfolio. The author points out that while concentration can be a strength, it also means that IYW’s performance is heavily tied to a handful of companies, which increases volatility.

The article also links to a Morningstar report that highlights IYW’s expense ratio (0.43%) and its high tracking error relative to a comparable ETF, Vanguard’s Information Technology ETF (VGT). VGT has a lower expense ratio of 0.10% and a more diversified weighting scheme. This comparison serves to reinforce the narrative that IYW may be overpaying for its exposure.

3. Understanding the PE Barrier

The central thesis of the article revolves around the “PE barrier.” The author explains that a PE ratio is a quick, yet powerful, gauge of how much investors are willing to pay for a company’s earnings. A high PE can signal that the market expects robust future growth, but it can also mean the stock is overvalued and vulnerable to a correction.

Key points:

- Historical Context – The average PE for the U.S. technology sector over the past decade has hovered around 20x. IYW’s 25x valuation sits at the upper extreme of the distribution, creating a psychological “ceiling” that could trigger a rebalancing by investors.

- Peer Comparison – The author links to an article on Bloomberg that shows VGT’s PE at 22x, and the Nasdaq‑100’s average at 27x. This comparison indicates that while the broader tech market remains lofty, IYW’s PE is comparatively higher, tightening the margin for error.

- Impact on New Investors – A PE barrier can deter “price‑sensitive” newcomers. The article cites a LinkedIn post by a portfolio manager who noted that “investors increasingly screen for valuation, and a 25x PE is a red flag for many.”

4. Macro Risks Amplifying the Concern

The article ties IYW’s valuation problem to broader macro factors:

- Interest Rate Increases – The Federal Reserve’s ongoing rate hikes have already pulled tech stocks out of favor. A higher discount rate reduces the present value of future earnings, disproportionately hurting growth‑heavy firms. The author includes a link to the Federal Reserve’s latest minutes to illustrate this point.

- Geopolitical Tensions – Ongoing US‑China trade frictions could impact companies such as NVIDIA and TSMC, which the author identifies as key growth drivers in IYW’s portfolio.

- Regulatory Scrutiny – The article references a recent SEC investigation into large technology companies, suggesting that potential legal costs could depress earnings and, by extension, valuations.

5. The Downgrade Recommendation in Practice

The author’s recommendation is clear: downgrade IYW from Buy to Hold. The reasoning is:

- High PE vs. Growth Potential – The premium paid for IYW may not be justified by the current macro‑risk environment.

- Competitive Alternatives – Investors could consider VGT or even a broad‑market ETF with technology exposure, such as QQQ, to reduce cost while still capturing the tech upside.

- Short‑Term Volatility – With the current rate trajectory, the article warns of a “volatility spike” that could temporarily depress IYW’s price.

The article encourages investors to monitor the fund’s NAV movements, the performance of its top holdings, and any changes in the fund’s allocation (for instance, the addition of semiconductor stocks that may further inflate the PE).

6. Potential Upside and Counterarguments

The author is not entirely negative. They acknowledge that:

- Earnings Growth – If the technology sector rebounds strongly, IYW could regain its premium.

- ETF’s Liquidity – IYW’s high liquidity makes it a convenient way to gain broad tech exposure without the need to purchase each individual stock.

- Long‑Term Outlook – Even with a high PE, the long‑term trajectory of the tech sector remains upward, which could justify a Hold recommendation for long‑term investors who are comfortable with the risk.

A link to an academic paper on technology stock valuations (available on SSRN) is used to support the idea that high PEs can persist if growth expectations remain strong.

7. Takeaway for Investors

The SeekingAlpha article concludes with a concise checklist for investors considering IYW:

- Assess Valuation – Compare the ETF’s PE to the sector’s average and to peer funds.

- Consider Expense Ratios – Higher costs reduce long‑term returns, especially when the price premium is high.

- Watch Macro Indicators – Rate hikes, geopolitical developments, and regulatory news can amplify downside risk.

- Diversify if Needed – For exposure to tech with lower cost and risk, VGT or a broader ETF may be preferable.

The final message: “IYW is still a robust vehicle for tech exposure, but its valuation ceiling now makes a downgrade logical. Investors should weigh the risk of a potential correction against their growth objectives.”

In Summary

The SeekingAlpha piece is a comprehensive, data‑driven argument that IYW’s high PE ratio, compounded by tightening macro conditions, justifies a downgrade from Buy to Hold. By linking to credible external sources—fact sheets, Morningstar reports, Bloomberg analyses, Fed minutes, and academic papers—the article offers a well‑rounded perspective that balances caution with the potential upside of the technology sector. Investors who rely on IYW for tech exposure should take note of the warning signs and consider whether the cost of the current valuation premium is worth the risk of a future correction.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4819934-iyw-technology-and-the-pe-barrier-downgrade ]