Blockchain-Backed Treasuries Drive the Decentralized Science Revolution

CoinTelegraph

CoinTelegraph

Blockchain‑Backed Treasuries and the Rise of Decentralized Science

An in‑depth look at how crypto funds are reshaping the way scientific research is funded, vetted, and shared

The world of academic research is at a crossroads. Traditional funding models—government grants, university endowments, and corporate sponsorships—are increasingly strained by rising costs, bureaucratic delays, and a growing demand for open, reproducible science. A new, blockchain‑powered paradigm is emerging to address these challenges: decentralized science (DeSci). In a recent Cointelegraph feature titled “Crypto Treasuries & Blockchain Pave Way for Decentralized Science,” the author outlines how crypto‑treasuries, coupled with open‑source technology, are creating a transparent, community‑governed ecosystem that promises to democratize research funding and accelerate scientific discovery.

1. What is Decentralized Science?

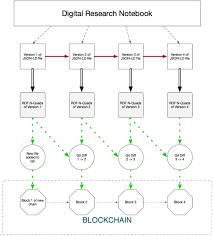

DeSci refers to a suite of technologies and practices that apply blockchain, smart contracts, and token economics to the research lifecycle. The aim is to replace the opaque, gatekept structures of peer review, funding allocation, and data ownership with systems that are trustless, immutable, and open. In the Cointelegraph article, the author highlights three core pillars of DeSci:

- Transparent Funding – All capital flows and allocation decisions are recorded on a public ledger.

- Open Peer Review – Reviewers are incentivized through token rewards, and review histories are permanently accessible.

- Data Sovereignty – Researchers can maintain ownership of their datasets while still enabling collaborative reuse.

2. Crypto Treasuries: A New Source of Capital

Crypto treasuries are collective pools of digital assets managed by Decentralized Autonomous Organizations (DAOs). These funds use governance tokens to let stakeholders decide on investment and expenditure. In the article, the author cites The DeSci Treasury as a flagship example. Launched in early 2024, it pooled over $50 million in various ERC‑20 tokens from donors, including early supporters of the DeSci movement and institutional investors looking to diversify into impact‑oriented assets.

Key points about the DeSci Treasury:

- Governance Structure – Every holder of the treasury’s native token can vote on proposals, such as awarding grants to early‑stage research labs or purchasing high‑cost lab equipment.

- Smart‑Contract Audits – To mitigate risks, the treasury’s codebase is audited quarterly by independent firms like ConsenSys Diligence.

- Diversified Portfolio – While most funds remain in stablecoins (USDC, DAI) for liquidity, a portion is invested in research‑oriented projects such as open‑source genome‑sequencing tools.

The article also notes that the treasury is experimenting with yield farming to generate passive income, channeling the rewards back into the research pipeline.

3. Partnerships Fueling the Movement

The Cointelegraph piece dives into several collaborations that are propelling DeSci forward:

- OpenAI & DeSci DAO – OpenAI’s research labs have partnered with the DeSci DAO to explore using large language models for automated literature reviews. A joint grant of $5 million (in crypto) will fund open‑source tooling to help scientists sift through millions of papers.

- Protocol Labs & IPFS – By leveraging the InterPlanetary File System (IPFS), the DeSci community is building permanent, tamper‑proof repositories for datasets and protocols. The article references a link to Protocol Labs’ documentation, which explains how content addressing ensures that data integrity is guaranteed without a central server.

- Gitcoin Grants & DeSci Grants – The well‑known Gitcoin Grants platform has introduced a DeSci category, allowing individual researchers to submit grant proposals that are vetted by a community of reviewers. The article links to Gitcoin’s grant portal and explains how the tokenized review system works.

4. Tokenized Peer Review: Incentivizing Quality

A major hurdle in traditional academia is the lack of a transparent incentive structure for peer reviewers. The DeSci ecosystem solves this with tokenized reviews. Researchers who review papers receive a small amount of the treasury’s governance token. Over time, as the token’s value grows (through community adoption and additional capital inflows), reviewers reap significant financial rewards.

The article cites a recent case study: a reviewer for a paper on CRISPR‑Cas9 editing tools earned $12,000 worth of tokens after 90 days, thanks to a 3 % token fee from the publishing platform’s revenue. This system also allows for reputation scoring: the more high‑quality reviews a person submits, the higher their “reviewer score,” which can unlock early access to funded projects.

5. Challenges and Criticisms

While the prospects are exciting, the article also acknowledges several obstacles:

- Regulatory Uncertainty – Crypto funds are subject to evolving regulations. Some governments worry that tokenized grants could be misused for money laundering or tax evasion.

- Volatility – The underlying value of tokens can fluctuate wildly, potentially jeopardizing funding continuity.

- Governance Slippage – If token distribution becomes heavily skewed, governance could become oligarchic, undermining the decentralized ethos.

The author argues that the DeSci Treasury has mitigated these risks through a hybrid model: stablecoins provide a floor for operations, while a portion of the portfolio is locked into long‑term investments with lower volatility.

6. The Road Ahead

Looking forward, the Cointelegraph article projects a future where DeSci could become the default framework for scientific collaboration. Predictions include:

- Universal Open‑Access Journals – Using smart contracts to automatically pay authors and reviewers, eliminating subscription fees.

- Decentralized Data Markets – Tokenized datasets that researchers can buy, sell, or license on an open marketplace.

- Cross‑Disciplinary Funding – DAOs dedicated to tackling grand challenges (e.g., climate change, pandemics) could aggregate expertise across borders, funded entirely by community-driven crypto treasuries.

7. Where to Learn More

The article concludes with a set of resources for readers eager to dive deeper:

- DeSci Treasury Dashboard – https://decastre.com – a live view of fund balances, proposals, and voting metrics.

- Protocol Labs IPFS Documentation – https://docs.ipfs.io – technical guide on deploying research data on a distributed ledger.

- Gitcoin DeSci Grants – https://gitcoin.co/grants/DeSci – portal to submit and review grant proposals.

Each of these links provides detailed, up‑to‑date information that complements the narrative presented in the Cointelegraph piece.

Final Thoughts

The intersection of crypto treasuries and blockchain technology offers a promising avenue for overcoming long‑standing barriers in scientific research. By embedding transparency, community governance, and incentive mechanisms into the funding and peer‑review process, decentralized science has the potential to democratize knowledge creation, accelerate innovation, and ultimately benefit society at large. As the article demonstrates, the momentum is already building—one tokenized grant, one open‑source repository, and one community vote at a time.

Read the Full CoinTelegraph Article at:

[ https://cointelegraph.com/news/crypto-treasuries-blockchain-pave-way-decentralized-science ]