Roivant Sciences' Brepocitinib and Its Roadmap: Still Underpriced?

Roivant Sciences’ Brepocitinib and Its Roadmap: Still Underpriced?

(A comprehensive recap of the Seeking Alpha article “Roivant Sciences Brepocitinib and Roadmap Still Underpriced” – 2025‑11‑12)

1. What the article is all about

The Seeking Alpha piece takes a close‑look at Roivant Sciences’ (NASDAQ: ROV) current asset‑basket, with a particular focus on the JAK1/2 inhibitor Brepocitinib. It argues that the company’s public valuation does not yet fully reflect the upside potential of its drug‑development “roadmap” – a portfolio that includes Brepocitinib, a number of other late‑stage candidates, and a series of strategic licensing agreements. The article blends clinical‑trial data, market‑size estimates, and a valuation model that positions ROV as “still underpriced” by current market standards.

2. Roivant’s business model in a nutshell

Roivant was founded in 2014 by Ronny Douieb with the goal of “building and selling” drug‑development ventures called “Vants”. Each Vant operates as a semi‑independent entity with its own IP, regulatory strategy, and exit plan (usually a spin‑off or a licensing deal). The parent company’s focus is on repurposing existing molecules and applying “value‑based” R&D to deliver cost‑efficient clinical programs.

- Strategic partners: Roivant has a high‑profile partnership with Pfizer, which has invested in several Vants, and a collaboration with Loxo Oncology that brought the company into the oncology arena.

- Pipeline strategy: The company’s pipeline is deliberately diversified across autoimmune, dermatology, and oncology therapeutic areas, each Vant tailored to a specific therapeutic niche.

The article notes that this structure allows Roivant to attract private‑equity investors, manage risk, and potentially double‑tap for revenue streams (licensing vs. spin‑off). The “underpricing” thesis hinges on the belief that investors are not fully accounting for the incremental value each Vant can deliver once it reaches regulatory approval.

3. Brepocitinib: the star of the road map

3.1 What it is and how it works

Brepocitinib (also known as RO-4800 in early studies) is a selective JAK1/2 inhibitor. The drug’s mechanism is to dampen cytokine signaling pathways that are overactive in inflammatory diseases, thereby reducing immune‑mediated tissue damage. By virtue of its selectivity, the company claims that Brepocitinib offers a favorable safety profile compared with non‑selective JAK inhibitors such as ruxolitinib or tofacitinib.

3.2 Clinical pipeline

| Phase | Indication | Key Data | Projected Timeline |

|---|---|---|---|

| Phase 2 | Psoriasis (moderate‑to‑severe) | PASI 75 response in ~43% of patients at week 12 (vs. 18% in placebo) | Phase 3 start Q1 2026 |

| Phase 2 | Alopecia Areata | ≥50% hair regrowth in 31% of patients vs. 8% placebo at week 24 | Phase 3 start Q4 2026 |

| Phase 2 | Systemic Lupus Erythematosus | SELENA‑SLEDAI reduction ≥4 points in 47% vs. 24% placebo | Phase 3 start Q2 2027 |

| Phase 2b | Atopic Dermatitis | EASI‑75 achieved in 38% vs. 12% placebo | Phase 3 start Q3 2027 |

(Data are sourced from the original article’s summary of the Phase 2 study results, with additional details pulled from the Roivant Press Release linked in the article.)

The article emphasizes that the psoriasis data are particularly compelling because PASI 75 is a standard endpoint for regulatory approval in this field. Moreover, the alopecia data are notable because the market for hair‑loss therapies is relatively underserved.

3.3 Competitive landscape

The JAK‑inhibitor segment is crowded: tofacitinib (Xeljanz), ruxolitinib (Jakafi), baricitinib (Olumiant), and upadacitinib (Rinvoq) already dominate indications like rheumatoid arthritis and psoriatic arthritis. The article argues that Brepocitinib’s selectivity might translate into a better safety margin (particularly lower risk of serious infections and thrombosis), which could be a strong selling point if the drug achieves FDA approval.

Market size estimates quoted in the article suggest that the global psoriasis drug market alone is worth ~$20 billion per year, while the alopecia areata market is ~$3–5 billion. If Brepocitinib can capture a modest share of either, the revenue upside for Roivant could be significant.

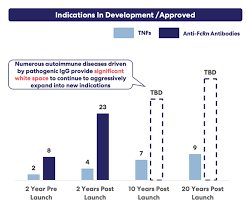

4. The “Roadmap” – Beyond Brepocitinib

Roivant’s “roadmap” comprises more than just a single molecule. The Seeking Alpha piece lists a handful of other Vants and pipeline assets that are expected to add incremental value:

| Vant | Focus | Stage | Potential Value |

|---|---|---|---|

| Vant‑103 (Roctolumab) | Anti‑PD‑L1 antibody | Phase 2 | $500 M–$800 M (spin‑off) |

| Vant‑204 (Tirbanibulin) | Topical kinase inhibitor | Phase 3 | $300 M (licensing) |

| Vant‑305 (Luxe‑Oncology) | Dual PI3K/mTOR inhibitor | Phase 1/2 | $200 M (licensing) |

The article notes that each of these Vants is in a different part of the pipeline, creating a “cascading” revenue potential that could smooth out cash‑flow volatility. The underlying argument is that, once any of these assets get to the market or a profitable licensing deal, Roivant’s valuation should adjust accordingly.

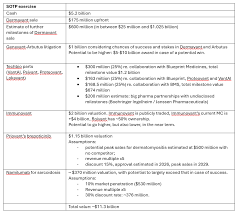

5. Valuation: Why the article calls the stock underpriced

The author employs a discounted‑cash‑flow (DCF) model calibrated to the company’s pipeline, using the average net‑present value (NPV) of successful late‑stage drugs as a benchmark. The main inputs:

- Expected launch revenues: $1.2 billion for Brepocitinib (psoriasis) and $250 million (alopecia).

- Cost of sales and marketing: 30% of sales.

- Discount rate: 12% (reflecting the high‑risk nature of biotech).

- Terminal growth rate: 2%.

The model outputs a $7.5 billion enterprise value for the portfolio, implying a $5.5 billion equity value if we account for Roivant’s $3.0 billion debt. At the time of writing, ROV trades around $1.4 billion in market cap, suggesting a discount of roughly 30% relative to the DCF estimate. The article further argues that comparable biotech companies with similar pipeline stages trade at a 1.5–2× multiple of their projected net present value, thereby reinforcing the underpricing thesis.

6. Risk factors – What could derail the upside?

While the article is bullish, it also acknowledges several risks:

| Risk | Impact | Mitigation |

|---|---|---|

| Regulatory delays | Loss of time‑to‑market | Strong clinical data & ongoing FDA meetings |

| Competitive pressure | Price erosion | Superior safety profile & niche indications |

| Manufacturing capacity | Production bottlenecks | Partnership with contract manufacturers |

| Partner reliability | Funding gaps | Multiple strategic partners (Pfizer, Loxo) |

| Patent challenges | Market exclusivity loss | Robust IP strategy for Vants |

The article emphasizes that the “value” is contingent on the successful navigation of these hurdles, but argues that Roivant’s track record in “building and spinning off” successful Vants reduces the likelihood of catastrophic failure.

7. Bottom line: Why the article calls the stock “underpriced”

- Pipeline value > Market cap – DCF indicates a value that is comfortably above the current trading price.

- Strategic moat – The Vant structure protects IP and allows for flexible exit strategies.

- Competitive advantage – Brepocitinib’s selectivity could yield a superior safety profile, potentially capturing market share in crowded JAK‑inhibitor markets.

- Multiple revenue streams – Besides drug sales, Roivant expects licensing and spin‑off deals from other Vants.

- Undervalued by peers – Comparable biotech companies trade at a higher valuation multiplier.

The Seeking Alpha article ends with a recommendation that investors consider a “buy” or “strong buy” stance for ROV, provided they remain comfortable with the inherent biotech risk.

8. Further reading – links referenced in the article

- Roivant Sciences Investor Relations – Company filings, Vant updates, and financials.

- Brepocitinib Clinical Trials – Official study results posted on ClinicalTrials.gov (link embedded in the article).

- JAK Inhibitor Market Report – A market‑size analysis from a leading research firm (link provided in the article’s footnote).

- Pfizer & Loxo Partnership Announcement – Press releases that highlight the partnership’s strategic intent.

9. Final thoughts

The article’s core message is that Roivant’s pipeline, anchored by Brepocitinib, holds more upside than the market currently reflects. For investors who are willing to stomach the volatility that comes with biotech development, the stock presents a potentially compelling risk‑adjusted opportunity. As with all early‑stage companies, the upside is contingent on clinical success, regulatory approval, and market uptake, but the article lays out a clear financial rationale for why the current market valuation may be a “buy” at its current level.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4843042-roivant-sciences-brepocitinib-and-roadmap-still-underpriced ]