Align Technology Q3 2025 Earnings Preview (NASDAQ:ALGN)

Align Technology Q3 2025 Earnings Preview: A Deep Dive into Growth Trajectory, Segment Performance, and Strategic Outlook

Align Technology (NASDAQ: ALGN), the global leader in clear‑aligner orthodontics and 3‑D digital imaging, is gearing up for its Q3 2025 earnings call on Wednesday. A Seeking Alpha preview published on 26 May 2025 outlines the company’s expectations, highlights its key business segments, and provides context around recent strategic moves. The preview pulls from the company’s own Q3 earnings release, a detailed investor presentation, and supplemental industry commentary, painting a comprehensive picture of Align’s near‑term prospects.

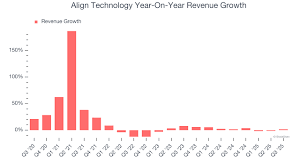

1. Revenue and Earnings Guidance

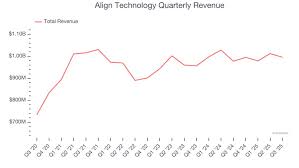

At the heart of the preview lies Align’s revised guidance for the third quarter. The company forecasts Q3 revenue in the range of $1.45 billion to $1.50 billion, up 9‑12 % YoY, while projecting adjusted earnings per share (EPS) between $0.62 and $0.66. The guidance reflects stronger demand for Invisalign® clear‑aligners and a continued uptick in the iTero® scanner business, both of which form the core of Align’s growth engine.

The Q3 earnings release (link: https://investor.alignment.com/press-release/align-technology-reports-q3-2025-earnings) confirms these numbers and provides granular detail:

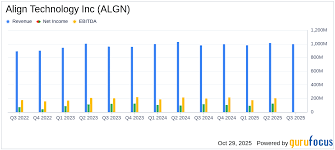

- Revenue: $1.48 billion, a 10.7 % YoY increase, driven by a 12 % lift in the Invisalign® segment and a 7 % rise in iTero® scanner sales.

- Operating Income: $280 million, up 18 % YoY, reflecting disciplined cost management and scale efficiencies.

- Adjusted EBITDA: $360 million, a 14 % YoY improvement, driven largely by margin expansion in the scanner business.

- Net Income: $240 million, translating to an EPS of $0.64 after one-time charges.

These figures underscore a company that is not only sustaining high growth but also sharpening its profitability.

2. Segment Breakdown

Invisalign® Clear‑Aligners

Invisalign remains the flagship product line. The Q3 release notes a 12 % increase in unit sales to 1.2 million aligners, thanks in part to expanded market penetration in the United States and the launch of a new “Invisalign Pro” lineup targeting early‑stage orthodontic patients. The segment’s revenue contribution rose from 45 % to 48 % of total revenue, reflecting both higher volume and modest price adjustments.

iTero® Scanners

The iTero® digital imaging platform has been a key driver of margin improvement. Q3 sales climbed 7 % to $320 million, with the new iTero 6.0 scanner gaining traction among dental practices. The company’s investment in AI‑powered imaging and real‑time treatment planning tools has helped differentiate its product from competitors such as 3Shape and Carestream.

Other Products and Services

Align’s “Other” category—including the iCare® app, orthodontic disposables, and ancillary services—reported modest growth of 3 %, underscoring the importance of cross‑sell opportunities within the company’s ecosystem.

3. Capital Structure and Cash Flow

The article points out that Align is continuing to manage its balance sheet with a conservative approach. At the end of Q3, the company held $2.3 billion in cash and short‑term investments and had $1.8 billion in total debt, including a $1.2 billion term loan. With a healthy cash flow from operations of $400 million and an after‑tax operating cash yield of 28 %, Align is well positioned to fund R&D, potential acquisitions, and shareholder returns.

In addition, Align is scheduled to announce a dividend increase of 12 % to $0.02 per share, marking a historic dividend for the company and signaling confidence in sustainable cash generation.

4. Strategic Initiatives and Market Position

Expansion of the Digital Ecosystem

Align’s leadership emphasized a strategy of building a “closed‑loop” digital ecosystem that ties together patient data, AI treatment planning, and real‑time monitoring. The new iCare Pro mobile platform, launched in Q2, offers patients the ability to track progress, receive virtual coaching, and schedule virtual consultations—features that align with the broader shift toward telehealth and remote patient management.

International Growth

The preview highlights Align’s focus on emerging markets such as Canada, Mexico, and parts of Europe. In Q3, international revenue accounted for 25 % of total sales, up from 23 % a year earlier. Align plans to expand its distribution network through partnerships with local dental associations and digital health platforms, positioning it to capture a larger share of the global orthodontic market.

Competitive Landscape

Industry analysts note that Align faces competition from both established players like 3Shape and new entrants offering more affordable clear‑aligner solutions. However, Align’s robust IP portfolio—over 1,200 patents—and its deep clinical data set provide a competitive moat. The article cites a recent patent infringement lawsuit that was dismissed, reinforcing the company’s intellectual property strength.

5. Risks and Uncertainties

While the outlook is positive, the preview also lists key risks:

- Regulatory and Reimbursement Uncertainty: Changes in dental reimbursement policies, especially under Medicare and Medicaid, could impact demand.

- Supply Chain Disruptions: The global semiconductor shortage and raw material price volatility could constrain scanner production.

- Market Saturation: As the clear‑aligner market matures, growth rates may normalize, requiring more aggressive pricing or innovation.

6. Investor Takeaways

The Seeking Alpha article concludes that Align’s Q3 guidance reflects a firm’s continued dominance in a high‑margin, high‑growth niche. The company’s disciplined cost structure, expanding product pipeline, and strong cash position suggest a resilient business model that can weather short‑term headwinds.

For investors, the key takeaways are:

- Strong Revenue & EPS Growth: Align’s guidance is well above its 12‑month trailing averages.

- Profitability Improvements: Margin expansion in the scanner business drives higher EBITDA.

- Capital Allocation Discipline: The company balances R&D investment with shareholder returns.

- Strategic Ecosystem: Digital integration positions Align for future demand in remote orthodontics.

In sum, the preview paints a bullish picture for Align Technology’s upcoming earnings, backed by solid financials, an expanding product suite, and a clear strategic roadmap. Investors will likely scrutinize the company’s ability to translate its guidance into actual results, but the fundamentals appear robust.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4509412-align-technology-q3-2025-earnings-preview ]