BSTZ: High Income, Significant Risks

Locale: UNITED STATES, CAYMAN ISLANDS

Tuesday, January 20th, 2026 - In the current market landscape, income-seeking investors are constantly searching for opportunities to generate reliable returns. BlueStar US Bond & Term Securities Trust (BSTZ), a closed-end fund (CEF), has been attracting attention due to its monthly income stream and a significant discount to its net asset value (NAV). However, a closer examination reveals a complex picture, combining potential rewards with substantial risks. This article will delve into BSTZ's strategy, performance, and the factors investors should consider before making a decision.

Understanding BSTZ: A Hybrid Approach

BSTZ operates as a CEF, a type of investment vehicle that pools capital from multiple investors to invest in a portfolio of assets. In BSTZ's case, the primary focus is on US bonds and term securities. This blend aims to provide a combination of current income and potential capital appreciation. The fund actively seeks out US bonds, which include a strategic allocation to high-yield bonds - those with a higher risk profile, but also offering a potentially higher yield. Diversification across various sectors and industries is a stated goal, intended to mitigate sector-specific risks. A key feature of BSTZ's approach is the utilization of leverage - borrowing money to amplify potential returns. While leverage can boost gains, it also significantly increases the potential for losses, a crucial consideration for risk-averse investors.

Performance Concerns and the Discount to NAV

While the allure of a double-digit distribution yield is strong, BSTZ's recent performance has been less encouraging. Year-to-date 2026, the fund has experienced a decline of approximately 14%. This negative performance raises concerns about the underlying portfolio and the effectiveness of the investment strategy. The current trading price reflects this apprehension, as BSTZ is currently trading at an 11.0% discount to its NAV.

This discount, while potentially presenting a buying opportunity, is also a warning sign. Discounts to NAV can indicate that the market perceives the fund's assets to be worth less than their stated value, or that there are concerns about future performance or management effectiveness. A sustained discount could suggest a lack of investor confidence. Historically, CEF discounts can narrow, offering a capital gain, but there's no guarantee this will occur with BSTZ.

Navigating the Risks: A Prudent Approach

Investing in BSTZ, or any CEF that utilizes leverage, necessitates a thorough understanding of the associated risks. The leverage employed by BSTZ magnifies both gains and losses. A rise in interest rates, a common concern in the current economic climate, would likely put downward pressure on bond prices, potentially impacting the fund's NAV. Furthermore, if BSTZ's portfolio is heavily concentrated in particular sectors that underperform, the fund could experience significant losses.

The fund's expense ratio, which represents the fees charged for managing the fund, is relatively high compared to some alternatives. These fees directly erode investor returns and are a critical factor when evaluating the long-term viability of an investment.

Looking Ahead: Is BSTZ a Buy?

BSTZ presents a complex investment proposition. The combination of a high distribution yield and a discount to NAV initially appears attractive. However, the fund's recent performance, reliance on leverage, potential vulnerability to rising interest rates, and relatively high expense ratio warrant cautious consideration.

Before investing, potential investors should:

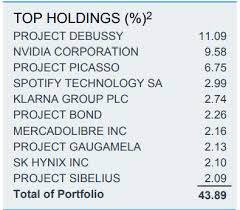

- Review the Fund's Holdings: Understand the specific bonds and term securities held within the portfolio and their exposure to various sectors and interest rate sensitivity.

- Assess Risk Tolerance: Leverage amplifies risk - ensure you're comfortable with the potential for substantial losses.

- Compare to Alternatives: Explore other CEF options and assess their performance, expense ratios, and risk profiles.

- Consider Market Conditions: Evaluate the broader economic environment and its potential impact on bond prices and the fund's overall performance.

While the discount to NAV offers a potential entry point, investors should conduct thorough due diligence and acknowledge the inherent risks before adding BSTZ to their portfolios. The promise of high income requires a careful balancing act with the potential for significant downside.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4861125-bstz-high-growth-potential-with-monthly-income-11-percent-discount-to-nav ]