Rare Earth Magnets: Key to EVs and Wind Turbines

Locales: Wyoming, Colorado, UNITED STATES

The Critical Role of Rare Earth Magnets

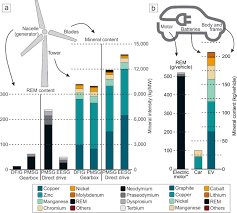

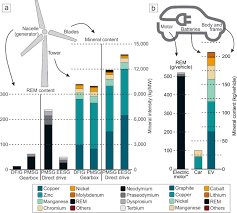

Rare earth magnets, specifically those utilizing neodymium and praseodymium, are integral to the functionality of both EVs and wind turbines. In EVs, these magnets are crucial for the high-performance traction motors that deliver power and efficiency. Wind turbines rely on them to generate electricity from renewable sources. Without a reliable supply of these magnets, the ambitious goals of transitioning to a sustainable energy future become significantly more challenging. The performance characteristics of EVs - range, power, and efficiency - are heavily influenced by the quality and supply of these magnets. Similarly, the viability of large-scale wind energy projects is dependent on consistent magnet availability.

MP Materials: From Mine to Magnet

MP Materials' core strength lies in its complete control over the rare earth supply chain. The company operates the Mountain Pass mine in California, a historically significant site that has undergone a remarkable revitalization under MP Materials' leadership. They don't just extract the raw materials; they process them into high-strength, permanent rare earth magnets. This vertical integration dramatically reduces reliance on overseas suppliers - particularly China, which has historically dominated the rare earth market - and mitigates risks associated with geopolitical instability and supply chain disruptions. The ability to control costs and quality throughout the entire process gives MP Materials a significant competitive edge.

Driving Forces Behind the Stock's Rise

Several key factors are converging to propel MP Materials' success:

- Exponential EV Growth: The global adoption of EVs continues to accelerate, driven by government regulations, consumer preferences, and technological advancements. Each new EV requires substantial quantities of rare earth magnets, fueling relentless demand.

- Renewable Energy Expansion: Beyond EVs, the worldwide commitment to renewable energy sources, especially wind power, is creating a parallel surge in demand for rare earth magnets. Large-scale wind farms require powerful, reliable magnets for efficient operation.

- National Security Implications: Rare earth magnets are not just crucial for clean energy; they are also vital for defense applications, including missile guidance systems and radar technology. This strategic importance makes MP Materials a key player in bolstering U.S. national security and reducing dependence on foreign suppliers.

- Government Backing: The U.S. government recognizes the critical need to secure a domestic rare earth supply chain. A combination of incentives, funding, and supportive policies is actively promoting companies like MP Materials to increase production and capacity within the United States. Recent legislation has further solidified these commitments.

- Robust Financial Performance: MP Materials has consistently demonstrated strong financial health, reporting consistent profitability and healthy free cash flow. This allows the company to reinvest in expansion projects, research and development, and return capital to shareholders.

Looking Ahead: Analyst Expectations and Growth Potential

Financial analysts remain overwhelmingly optimistic about MP Materials' future prospects. The median price target currently stands at $128 per share as of February 13th, 2026, representing a potential upside of approximately 26% from the current trading price. Analysts predict continued growth in revenue and earnings as the company ramps up production and capitalizes on the expanding demand for rare earth magnets. Further expansion of the Mountain Pass mine and investment in advanced processing technologies are expected to drive future growth.

Navigating the Risks

While the outlook for MP Materials appears bright, investors should be aware of potential risks. A significant economic downturn could dampen demand for EVs and renewable energy technologies. Increased competition from Chinese producers, despite MP Materials' advantages, remains a concern. Fluctuations in raw material prices could also impact profitability. However, MP Materials' vertical integration, strategic importance, and government support offer a significant buffer against these challenges.

Investment Thesis: A Compelling Opportunity

MP Materials is uniquely positioned to capitalize on the long-term trends driving demand for rare earth magnets. Its strong fundamentals, vertically integrated business model, strategic national importance, and supportive government policies make it an attractive investment opportunity for those seeking exposure to the rapidly growing clean energy and electric vehicle sectors. While inherent risks exist within any investment, the potential rewards associated with MP Materials appear to substantially outweigh them.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/13/heres-why-mp-materials-continues-to-soar-in-2026/ ]